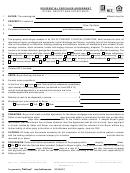

Residential Purchase Agreement Template - Offer, Receipt And Acceptance Page 2

ADVERTISEMENT

Property Address:

43

TITLE: Seller shall convey a marketable title to Buyer by general warranty deed and/or fiduciary deed, if required,

44

with dower rights released, free and clear of all liens and encumbrances whatsoever, except a) any mortgage

45

assumed by Buyer, b) such restrictions, conditions, easements (however created) and encroachments as do not

46

materially adversely affect the use or value of the property, c) zoning ordinances, if any, and d) taxes and

47

assessments, both general and special, not yet due and payable. Seller shall furnish an Owner's Fee Policy of

48

Title Insurance in the amount of the purchase price. Seller shall have thirty (30) days after notice to remove title

49

defects. If unable to do so, Buyer may either a) accept Title subject to each defect without any reduction in the

50

purchase price or b) terminate this agreement, in which case neither Buyer, Seller nor any broker shall have any

51

further liability to each other, and both Buyer and Seller agree to sign a mutual release, releasing earnest money

52

to Buyer. (see line 196)

53

PRORATIONS: General taxes, annual maintenance fees, subdivision charges, special assessments, city and

54

county charges and tenant's rents, collected or uncollected, shall be prorated as of the date the title has been

55

recorded. Taxes and assessments shall be prorated based upon the latest available tax duplicate. However, if the

56

tax duplicate is not yet available or the improved land is currently valued as land only, taxes and assessments shall

57

be prorated based upon 35% of the selling price times the millage rate. The escrow agent is instructed to contact

58

the local governmental taxing authority, verify the correct tax value of the property as of the date the title has been

59

recorded and pay the current taxes due to the date the title has been recorded. If the property being transferred is

60

new construction and recently completed or in the process of completion at the time the agreement was signed by

61

the parties, the escrow agent is instructed to make a good faith estimate of the taxes to be owed on the value of the

62

improved property to the date the title has been recorded and reserve sufficient funds in escrow from Seller's net

63

proceeds to pay those taxes when they become due and payable after the title has been recorded. The escrow

64

agent is instructed to release the balance of the funds on reserve to Seller once they receive notice from the local

65

county auditor that the taxes on the land and improvements have been paid in full to the date the title has been

66

recorded. Buyer acknowledges that the latest available tax duplicate may not reflect the accurate amount of taxes

67

and assessments that will be owed. Seller agrees to reimburse Buyer directly outside of escrow for any increase in

68

valuation and the cost of all passed or levied, but not yet certified, taxes and assessments, if any, prorated to the

69

date the title has been recorded. Seller is not aware of any proposed taxes or assessments, public or private,

70

except the following:

71

72

In the event the property shall be deemed subject to any agricultural tax recoupment (C.A.U.V.),

73

Buyer

Seller agrees to pay the amount of such recoupment.

74

CHARGES/ESCROW INSTRUCTIONS: This agreement shall be used as escrow instructions subject to the

75

Escrow Agent's usual conditions of acceptance.

76

Seller shall pay the following costs through escrow: a) deed preparation b) real estate transfer tax, c) any amount

77

required to discharge any mortgage, lien or encumbrance not assumed by Buyer, d) title exam and one half the

78

cost of insuring premium for Owners Fee Policy of Title Insurance, e) pro-rations due Buyer, f) Broker's

79

commissions, g) one-half of the escrow fee (unless VA/FHA regulations prohibit payment of escrow fees by Buyer

80

in which case Seller shall pay the entire escrow fee), and h)

.

81

Tenant security deposits, if any, shall be credited in escrow to the Buyer. The escrow agent shall withhold

82

$

from the proceeds due Seller for payment of Seller's final water and

83

sewer bills. Seller shall pay all utility charges to date of recording of title or date of possession whichever is later.

84

Buyer shall pay the following through escrow (unless prohibited by VA/FHA regulations): a) one-half of the escrow

85

fee b) one half the cost of insuring premiums for Owners Fee Policy of Title Insurance; c) all recording fees for the

86

deed and any mortgage, d)

. If requested,

87

by Broker, the Seller(s) and Buyer(s) hereby authorize and instruct the escrow agent to send a copy of their fully

88

signed HUD1 Settlement Statement to their respective Broker(s) listed on this Agreement promptly after closing.

89

HOME WARRANTY: Buyer acknowledges that Limited Home Warranty Insurance Policies are available and that

90

such policies have deductibles, may not cover pre-existing defects in the property, and have items excluded from

91

coverage. Broker may receive a fee from the home warranty provider. Buyer

does

does not elect to secure a

92

Limited Home Warranty Plan issued by

. The cost of $

93

shall be paid by

Buyer

Seller through escrow.

_____________ ____________

_____________ _____________

Page 2 of 5

BUYER'S INITIALS AND DATE

RESIDENTIAL PURCHASE AGREEMENT

SELLER'S INITIALS AND DATE

NEOHREX 03/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5