Instructions For Form Ftb 3521 - Low-Income Housing Credit - 2016

ADVERTISEMENT

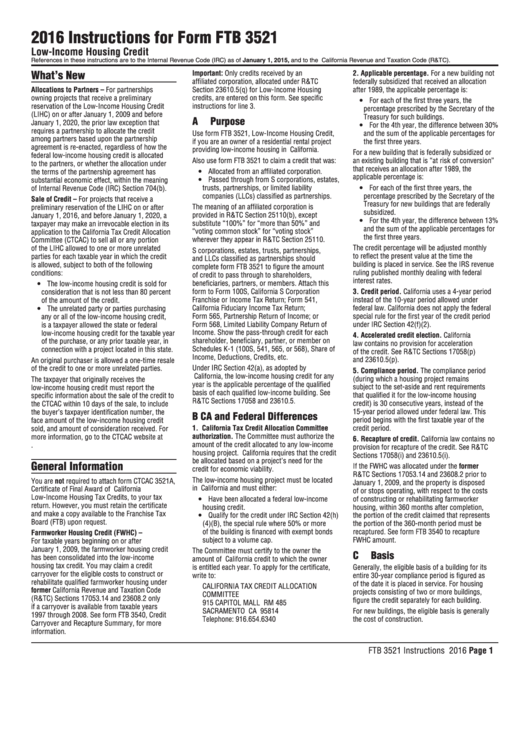

2016 Instructions for Form FTB 3521

Low-Income Housing Credit

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

What’s New

Important: Only credits received by an

2. Applicable percentage. For a new building not

affiliated corporation, allocated under R&TC

federally subsidized that received an allocation

Allocations to Partners – For partnerships

Section 23610.5(q) for Low-Income Housing

after 1989, the applicable percentage is:

owning projects that receive a preliminary

credits, are entered on this form. See specific

y For each of the first three years, the

reservation of the Low-Income Housing Credit

instructions for line 3.

percentage prescribed by the Secretary of the

(LIHC) on or after January 1, 2009 and before

Treasury for such buildings.

A

Purpose

January 1, 2020, the prior law exception that

y For the 4th year, the difference between 30%

requires a partnership to allocate the credit

Use form FTB 3521, Low-Income Housing Credit,

and the sum of the applicable percentages for

among partners based upon the partnership

if you are an owner of a residential rental project

the first three years.

agreement is re-enacted, regardless of how the

providing low-income housing in California.

For a new building that is federally subsidized or

federal low-income housing credit is allocated

Also use form FTB 3521 to claim a credit that was:

an existing building that is “at risk of conversion”

to the partners, or whether the allocation under

that receives an allocation after 1989, the

y Allocated from an affiliated corporation.

the terms of the partnership agreement has

applicable percentage is:

y Passed through from S corporations, estates,

substantial economic effect, within the meaning

trusts, partnerships, or limited liability

y For each of the first three years, the

of Internal Revenue Code (IRC) Section 704(b).

companies (LLCs) classified as partnerships.

percentage prescribed by the Secretary of the

Sale of Credit – For projects that receive a

Treasury for new buildings that are federally

The meaning of an affiliated corporation is

preliminary reservation of the LIHC on or after

subsidized.

provided in R&TC Section 25110(b), except

January 1, 2016, and before January 1, 2020, a

y For the 4th year, the difference between 13%

substitute “100%” for “more than 50%” and

taxpayer may make an irrevocable election in its

and the sum of the applicable percentages for

“voting common stock” for “voting stock”

application to the California Tax Credit Allocation

the first three years.

wherever they appear in R&TC Section 25110.

Committee (CTCAC) to sell all or any portion

The credit percentage will be adjusted monthly

of the LIHC allowed to one or more unrelated

S corporations, estates, trusts, partnerships,

to reflect the present value at the time the

parties for each taxable year in which the credit

and LLCs classified as partnerships should

building is placed in service. See the IRS revenue

is allowed, subject to both of the following

complete form FTB 3521 to figure the amount

ruling published monthly dealing with federal

conditions:

of credit to pass through to shareholders,

interest rates.

beneficiaries, partners, or members. Attach this

y The low-income housing credit is sold for

form to Form 100S, California S Corporation

3. Credit period. California uses a 4-year period

consideration that is not less than 80 percent

Franchise or Income Tax Return; Form 541,

instead of the 10-year period allowed under

of the amount of the credit.

California Fiduciary Income Tax Return;

federal law. California does not apply the federal

y The unrelated party or parties purchasing

Form 565, Partnership Return of Income; or

special rule for the first year of the credit period

any or all of the low-income housing credit,

Form 568, Limited Liability Company Return of

under IRC Section 42(f)(2).

is a taxpayer allowed the state or federal

Income. Show the pass-through credit for each

low-income housing credit for the taxable year

4. Accelerated credit election. California

shareholder, beneficiary, partner, or member on

of the purchase, or any prior taxable year, in

law contains no provision for acceleration

Schedules K-1 (100S, 541, 565, or 568), Share of

connection with a project located in this state.

of the credit. See R&TC Sections 17058(p)

Income, Deductions, Credits, etc.

and 23610.5(p).

An original purchaser is allowed a one-time resale

Under IRC Section 42(a), as adopted by

of the credit to one or more unrelated parties.

5. Compliance period. The compliance period

California, the low-income housing credit for any

(during which a housing project remains

The taxpayer that originally receives the

year is the applicable percentage of the qualified

subject to the set-aside and rent requirements

low-income housing credit must report the

basis of each qualified low-income building. See

that qualified it for the low-income housing

specific information about the sale of the credit to

R&TC Sections 17058 and 23610.5.

credit) is 30 consecutive years, instead of the

the CTCAC within 10 days of the sale, to include

15-year period allowed under federal law. This

the buyer’s taxpayer identification number, the

B

CA and Federal Differences

period begins with the first taxable year of the

face amount of the low-income housing credit

1. California Tax Credit Allocation Committee

credit period.

sold, and amount of consideration received. For

authorization. The Committee must authorize the

more information, go to the CTCAC website at

6. Recapture of credit. California law contains no

amount of the credit allocated to any low-income

treasurer.ca.gov/ctcac.

provision for recapture of the credit. See R&TC

housing project. California requires that the credit

Sections 17058(i) and 23610.5(i).

be allocated based on a project’s need for the

General Information

If the FWHC was allocated under the former

credit for economic viability.

R&TC Sections 17053.14 and 23608.2 prior to

The low-income housing project must be located

You are not required to attach form CTCAC 3521A,

January 1, 2009, and the property is disposed

in California and must either:

Certificate of Final Award of California

of or stops operating, with respect to the costs

Low-Income Housing Tax Credits, to your tax

y Have been allocated a federal low-income

of constructing or rehabilitating farmworker

return. However, you must retain the certificate

housing credit.

housing, within 360 months after completion,

and make a copy available to the Franchise Tax

y Qualify for the credit under IRC Section 42(h)

the portion of the credit claimed that represents

Board (FTB) upon request.

(4)(B), the special rule where 50% or more

the portion of the 360-month period must be

of the building is financed with exempt bonds

recaptured. See form FTB 3540 to recapture

Farmworker Housing Credit (FWHC) –

subject to a volume cap.

FWHC amount.

For taxable years beginning on or after

January 1, 2009, the farmworker housing credit

The Committee must certify to the owner the

C

Basis

has been consolidated into the low-income

amount of California credit to which the owner

housing tax credit. You may claim a credit

is entitled each year. To apply for the certificate,

Generally, the eligible basis of a building for its

carryover for the eligible costs to construct or

write to:

entire 30-year compliance period is figured as

rehabilitate qualified farmworker housing under

of the date it is placed in service. For housing

CALIFORNIA TAX CREDIT ALLOCATION

former California Revenue and Taxation Code

projects consisting of two or more buildings,

COMMITTEE

(R&TC) Sections 17053.14 and 23608.2 only

figure the credit separately for each building.

915 CAPITOL MALL RM 485

if a carryover is available from taxable years

SACRAMENTO CA 95814

For new buildings, the eligible basis is generally

1997 through 2008. See form FTB 3540, Credit

Telephone: 916.654.6340

the cost of construction.

Carryover and Recapture Summary, for more

information.

FTB 3521 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2