Form Mhw-4 - Employee'S Withholding Certificate For City Of Muskegon Heights Income Tax

ADVERTISEMENT

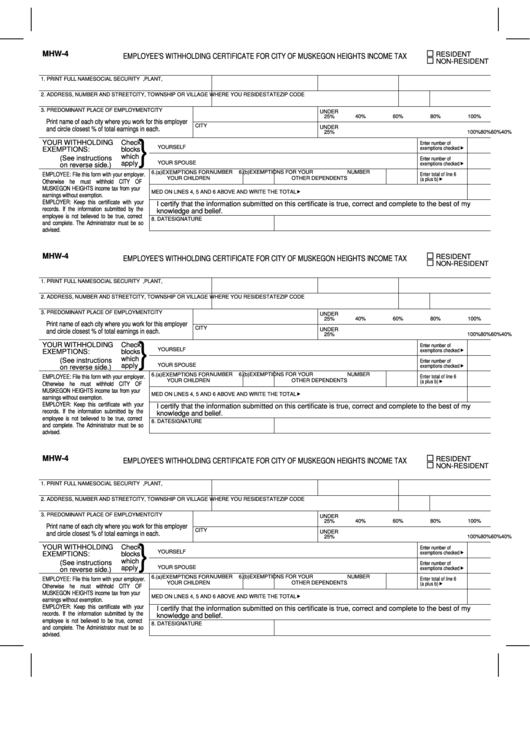

MHW-4

RESIDENT

EMPLOYEE'S WITHHOLDING CERTIFICATE FOR CITY OF MUSKEGON HEIGHTS INCOME TAX

NON-RESIDENT

1. PRINT FULL NAME

SOCIAL SECURITY NO.

OFFICE, PLANT, DEPT.

EMPLOYEE IDENTIFICATION NO.

2. ADDRESS, NUMBER AND STREET

CITY, TOWNSHIP OR VILLAGE WHERE YOU RESIDE

STATE

ZIP CODE

3. PREDOMINANT PLACE OF EMPLOYMENT

CITY

UNDER

25%

40%

60%

80%

100%

Print name of each city where you work for this employer

CITY

UNDER

and circle closest % of total earnings in each.

25%

40%

60%

80%

100%

}

4. EXEMPTIONS FOR

YOUR WITHHOLDING

Check

Enter number of

YOURSELF

exemptions checked

EXEMPTIONS:

blocks

which

5. EXEMPTIONS FOR

(See instructions

Enter number of

apply

YOUR SPOUSE

exemptions checked

on reverse side.)

6. (a) EXEMPTIONS FOR

NUMBER

6. (b) EXEMPTIONS FOR YOUR

NUMBER

EMPLOYEE: File this form with your employer.

Enter total of line 6

YOUR CHILDREN

OTHER DEPENDENTS

(a plus b)

Otherwise he must withhold CITY OF

MUSKEGON HEIGHTS income tax from your

7. ADD THE NUMBER OF EXEMPTIONS WHICH YOU HAVE CLAIMED ON LINES 4, 5 AND 6 ABOVE AND WRITE THE TOTAL

earnings without exemption.

EMPLOYER: Keep this certificate with your

I certify that the information submitted on this certificate is true, correct and complete to the best of my

records. If the information submitted by the

knowledge and belief.

employee is not believed to be true, correct

8. DATE

SIGNATURE

and complete. The Administrator must be so

advised.

MHW-4

RESIDENT

EMPLOYEE'S WITHHOLDING CERTIFICATE FOR CITY OF MUSKEGON HEIGHTS INCOME TAX

NON-RESIDENT

1. PRINT FULL NAME

SOCIAL SECURITY NO.

OFFICE, PLANT, DEPT.

EMPLOYEE IDENTIFICATION NO.

2. ADDRESS, NUMBER AND STREET

CITY, TOWNSHIP OR VILLAGE WHERE YOU RESIDE

STATE

ZIP CODE

3. PREDOMINANT PLACE OF EMPLOYMENT

CITY

UNDER

25%

40%

60%

80%

100%

Print name of each city where you work for this employer

CITY

UNDER

and circle closest % of total earnings in each.

25%

40%

60%

80%

100%

}

4. EXEMPTIONS FOR

YOUR WITHHOLDING

Check

Enter number of

YOURSELF

exemptions checked

EXEMPTIONS:

blocks

which

5. EXEMPTIONS FOR

(See instructions

Enter number of

apply

YOUR SPOUSE

exemptions checked

on reverse side.)

6. (a) EXEMPTIONS FOR

NUMBER

6. (b) EXEMPTIONS FOR YOUR

NUMBER

EMPLOYEE: File this form with your employer.

Enter total of line 6

YOUR CHILDREN

OTHER DEPENDENTS

(a plus b)

Otherwise he must withhold CITY OF

MUSKEGON HEIGHTS income tax from your

7. ADD THE NUMBER OF EXEMPTIONS WHICH YOU HAVE CLAIMED ON LINES 4, 5 AND 6 ABOVE AND WRITE THE TOTAL

earnings without exemption.

EMPLOYER: Keep this certificate with your

I certify that the information submitted on this certificate is true, correct and complete to the best of my

records. If the information submitted by the

knowledge and belief.

employee is not believed to be true, correct

8. DATE

SIGNATURE

and complete. The Administrator must be so

advised.

MHW-4

RESIDENT

EMPLOYEE'S WITHHOLDING CERTIFICATE FOR CITY OF MUSKEGON HEIGHTS INCOME TAX

NON-RESIDENT

1. PRINT FULL NAME

SOCIAL SECURITY NO.

OFFICE, PLANT, DEPT.

EMPLOYEE IDENTIFICATION NO.

2. ADDRESS, NUMBER AND STREET

CITY, TOWNSHIP OR VILLAGE WHERE YOU RESIDE

STATE

ZIP CODE

3. PREDOMINANT PLACE OF EMPLOYMENT

CITY

UNDER

25%

40%

60%

80%

100%

Print name of each city where you work for this employer

CITY

UNDER

and circle closest % of total earnings in each.

40%

60%

80%

100%

25%

}

4. EXEMPTIONS FOR

YOUR WITHHOLDING

Check

Enter number of

YOURSELF

exemptions checked

EXEMPTIONS:

blocks

which

5. EXEMPTIONS FOR

(See instructions

Enter number of

apply

YOUR SPOUSE

exemptions checked

on reverse side.)

6. (a) EXEMPTIONS FOR

NUMBER

6. (b) EXEMPTIONS FOR YOUR

NUMBER

EMPLOYEE: File this form with your employer.

Enter total of line 6

YOUR CHILDREN

OTHER DEPENDENTS

(a plus b)

Otherwise he must withhold CITY OF

MUSKEGON HEIGHTS income tax from your

7. ADD THE NUMBER OF EXEMPTIONS WHICH YOU HAVE CLAIMED ON LINES 4, 5 AND 6 ABOVE AND WRITE THE TOTAL

earnings without exemption.

EMPLOYER: Keep this certificate with your

I certify that the information submitted on this certificate is true, correct and complete to the best of my

records. If the information submitted by the

knowledge and belief.

employee is not believed to be true, correct

8. DATE

SIGNATURE

and complete. The Administrator must be so

advised.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2