New Client Sheet - Individual - Associates In Accounting Cpa Page 2

ADVERTISEMENT

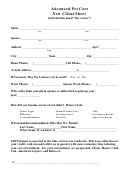

Individual Client Services/Fees

To be filled in by Accountant

Engagement / Fee Estimates

Engagement/Project

Fee

Engagement/Project

Fee

INDIVIDUAL CLIENT

SCHEDULE C BUSINESS

TAX SERVICES

TAX SERVICES

1040 (Individual)

KY 725 (Disregarded Entity)

1040 Amend

KY 62A500 (Property Tax)

1040 Ministers

Louisville OL-3

1040 Past

1040 Priority

PAYROLL TAX

1040 Re-Do

Annual Payroll Tax

1041 (Fiduciary – Estate)

Active Quarterly Payroll Tax

1041 (Fiduciary – Trust)

Zero Quarterly Payroll Tax

1041 Past

3Z4A Quarterly Payroll Tax

709 (Gift Taxes)

Annual W-2

Annual 1099/1096

CONSULT

K-1 Monthly Payroll Tax (Kentucky)

Consult

WH-1 Monthly Payroll Tax

Correspondence

Local Monthly Payroll Tax

941 Monthly Payroll Tax

TAX PLANNING

Tax Estimate

SALES TAX

Sales Tax Annual

Sales Tax Quarterly

Sales Tax Monthly

Originator _________________

Partner

__________________

Client ID _________________

Manager

__________________

Accountant who met with client

_______________________________

----------------------------------------------------------------------------------------------------------------------------------------------------------------------

Administrative Checklist (initial and date each line)

Set up in Practice

_____________

Thank you Note

__________________

Set up Projects

_____________

Services Agreement Package

__________________

Set up in Drake

_____________

Set up Project Envelope

__________________

Set up in Doc Mgr

_____________

Set up in Constant Contact

__________________

Interaction Sheets in Doc Mgr

_________

Scan new client sheet into Doc Mgr

__________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2