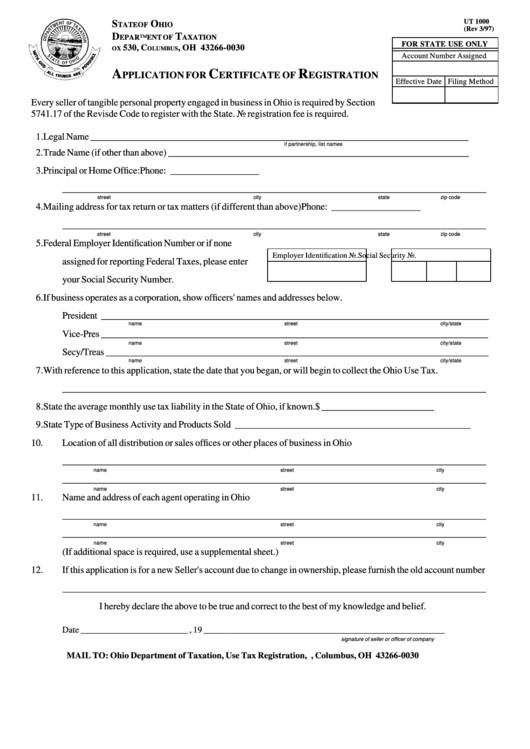

UT 1000

S

O

TATE OF

HIO

(Rev 3/97)

D

T

EPARTMENT OF

AXATION

FOR STATE USE ONLY

P.O. B

530, C

, OH 43266-0030

OX

OLUMBUS

Account Number Assigned

A

C

R

PPLICATION FOR

ERTIFICATE OF

EGISTRATION

Effective Date Filing Method

Every seller of tangible personal property engaged in business in Ohio is required by Section

5741.17 of the Revisde Code to register with the State. No registration fee is required.

1.

Legal Name _________________________________________________________________________________

if partnership, list names

2.

Trade Name (if other than above) ________________________________________________________________

3.

Principal or Home Office:

Phone: ___________________

___________________________________________________________________________________________

street

city

state

zip code

4.

Mailing address for tax return or tax matters (if different than above)

Phone: ___________________

___________________________________________________________________________________________

street

city

state

zip code

5.

Federal Employer Identification Number or if none

Employer Identification No.

Social Security No.

assigned for reporting Federal Taxes, please enter

your Social Security Number.

6.

If business operates as a corporation, show officers' names and addresses below.

President ___________________________________________________________________________________

name

street

city/state

Vice-Pres ___________________________________________________________________________________

name

street

city/state

Secy/Treas __________________________________________________________________________________

name

street

city/state

7.

With reference to this application, state the date that you began, or will begin to collect the Ohio Use Tax.

___________________________________________________________________________________________

8.

State the average monthly use tax liability in the State of Ohio, if known.

$ ________________________

9.

State Type of Business Activity and Products Sold __________________________________________________

10.

Location of all distribution or sales offices or other places of business in Ohio

___________________________________________________________________________________________

name

street

city

___________________________________________________________________________________________

name

street

city

11.

Name and address of each agent operating in Ohio

___________________________________________________________________________________________

name

street

city

___________________________________________________________________________________________

name

street

city

(If additional space is required, use a supplemental sheet.)

12.

If this application is for a new Seller's account due to change in ownership, please furnish the old account number

___________________________________________________________________________________________

I hereby declare the above to be true and correct to the best of my knowledge and belief.

Date ________________________ , 19 ______

_________________________________________________

signature of seller or officer of company

MAIL TO: Ohio Department of Taxation, Use Tax Registration, P.O. Box 530, Columbus, OH 43266-0030

1

1