Clear This Page

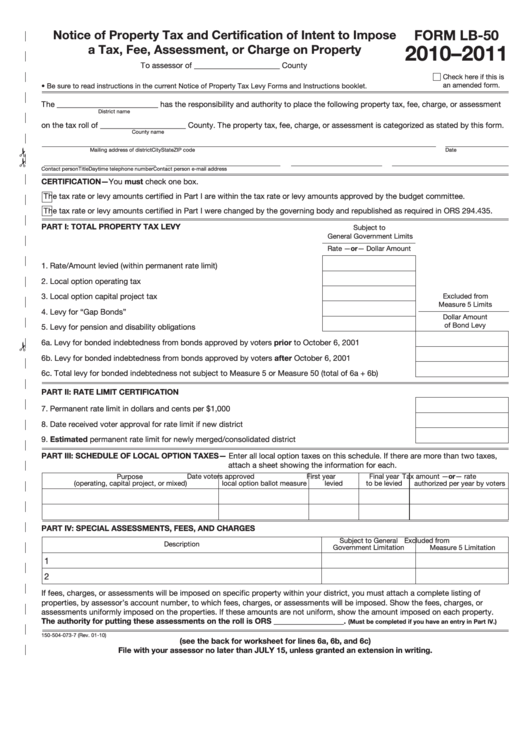

FORM LB-50

Notice of Property Tax and Certification of Intent to Impose

2010–2011

a Tax, Fee, Assessment, or Charge on Property

To assessor of ______________________ County

Check here if this is

an amended form.

• Be sure to read instructions in the current Notice of Property Tax Levy Forms and Instructions booklet.

The __________________________ has the responsibility and authority to place the following property tax, fee, charge, or assessment

District name

on the tax roll of ______________________ County. The property tax, fee, charge, or assessment is categorized as stated by this form.

County name

Mailing address of district

City

State

ZIP code

Date

Contact person

Title

Daytime telephone number

Contact person e-mail address

CERTIFICATION—You must check one box.

The tax rate or levy amounts certified in Part I are within the tax rate or levy amounts approved by the budget committee.

The tax rate or levy amounts certified in Part I were changed by the governing body and republished as required in ORS 294.435.

PART I: TOTAL PROPERTY TAX LEVY

Subject to

General Government Limits

Rate —or— Dollar Amount

1. Rate/Amount levied (within permanent rate limit) ..........................................1

2. Local option operating tax .............................................................................2

3. Local option capital project tax ......................................................................3

Excluded from

Measure 5 Limits

4. Levy for “Gap Bonds” ....................................................................................4

Dollar Amount

of Bond Levy

5. Levy for pension and disability obligations ....................................................5

6a. Levy for bonded indebtedness from bonds approved by voters prior to October 6, 2001 ....................6a

6b. Levy for bonded indebtedness from bonds approved by voters after October 6, 2001 ....................... 6b

6c. Total levy for bonded indebtedness not subject to Measure 5 or Measure 50 (total of 6a + 6b) ............6c

PART II: RATE LIMIT CERTIFICATION

7. Permanent rate limit in dollars and cents per $1,000 ................................................................................7

8. Date received voter approval for rate limit if new district ..........................................................................8

9. Estimated permanent rate limit for newly merged/consolidated district .................................................9

PART III: SCHEDULE OF LOCAL OPTION TAXES— Enter all local option taxes on this schedule. If there are more than two taxes,

attach a sheet showing the information for each.

Purpose

Date voters approved

First year

Final year

Tax amount —or— rate

(operating, capital project, or mixed)

local option ballot measure

levied

to be levied

authorized per year by voters

PART IV: SPECIAL ASSESSMENTS, FEES, AND CHARGES

Subject to General

Excluded from

Description

Government Limitation

Measure 5 Limitation

1

2

If fees, charges, or assessments will be imposed on specific property within your district, you must attach a complete listing of

properties, by assessor’s account number, to which fees, charges, or assessments will be imposed. Show the fees, charges, or

assessments uniformly imposed on the properties. If these amounts are not uniform, show the amount imposed on each property.

The authority for putting these assessments on the roll is ORS __________________.

(Must be completed if you have an entry in Part IV.)

150-504-073-7 (Rev. 01-10)

(see the back for worksheet for lines 6a, 6b, and 6c)

File with your assessor no later than JULY 15, unless granted an extension in writing.

1

1 2

2