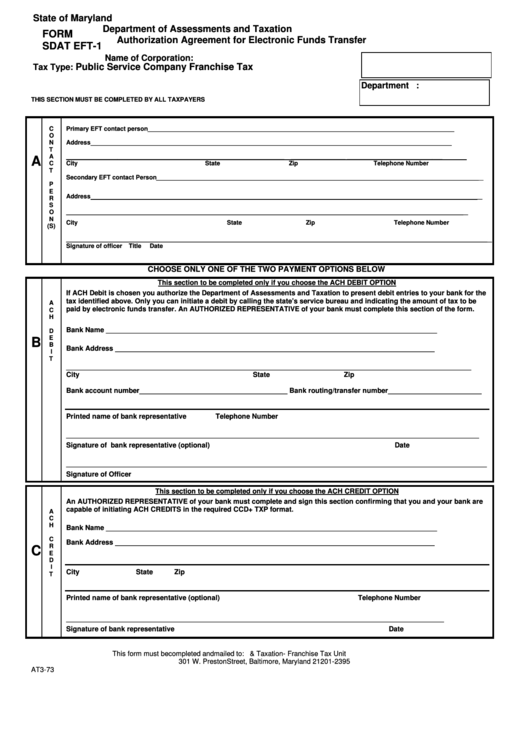

State of Maryland

Department of Assessments and Taxation

FORM

Authorization Agreement for Electronic Funds Transfer

SDAT EFT-1

Name of Corporation:

Public Service Company Franchise Tax

Tax Type:

Department I.D. Number:

THIS SECTION MUST BE COMPLETED BY ALL TAXPAYERS

C

Primary EFT contact person__________________________________________________________________________________________

O

N

Address__________________________________________________________________________________________________________

T

A

________________________________________________________________

________________ ____________________________

A

C

City

State

Zip

Telephone Number

T

Secondary EFT contact Person________________________________________________________________________________________________

P

E

Address___________________________________________________________________________________________________________________

R

S

O

______________________________________________________________________________________________________________________

N

City

State

Zip

Telephone Number

(S)

_____________________________________________________________________________________________________________________________

Signature of officer

Title

Date

CHOOSE ONLY ONE OF THE TWO PAYMENT OPTIONS BELOW

This section to be completed only if you choose the ACH DEBIT OPTION

If ACH Debit is chosen you authorize the Department of Assessments and Taxation to present debit entries to your bank for the

tax identified above. Only you can initiate a debit by calling the state’s service bureau and indicating the amount of tax to be

A

paid by electronic funds transfer. An AUTHORIZED REPRESENTATIVE of your bank must complete this section of the form.

C

H

Bank Name _____________________________________________________________________________________

D

E

B

B

Bank Address __________________________________________________________________________________

I

T

________________________________________________________________________________________________________

City

State

Zip

Bank account number______________________________________ Bank routing/transfer number________________________

Printed name of bank representative

Telephone Number

__________________________________________________________________________________________________________

Signature of bank representative (optional)

Date

____________________________________________________________________________________________________________

Signature of Officer

This section to be completed only if you choose the ACH CREDIT OPTION

An AUTHORIZED REPRESENTATIVE of your bank must complete and sign this section confirming that you and your bank are

capable of initiating ACH CREDITS in the required CCD+ TXP format.

A

C

H

Bank Name _____________________________________________________________________________________

C

Bank Address __________________________________________________________________________________

R

C

E

D

I

City

State

Zip

T

Printed name of bank representative (optional)

Telephone Number

_________________________________________________________________________________________________

Signature of bank representative

Date

This form must be completed and mailed to: Dept. of Assessments & Taxation - Franchise Tax Unit

301 W. Preston Street, Baltimore, Maryland 21201-2395

AT3-73

1

1