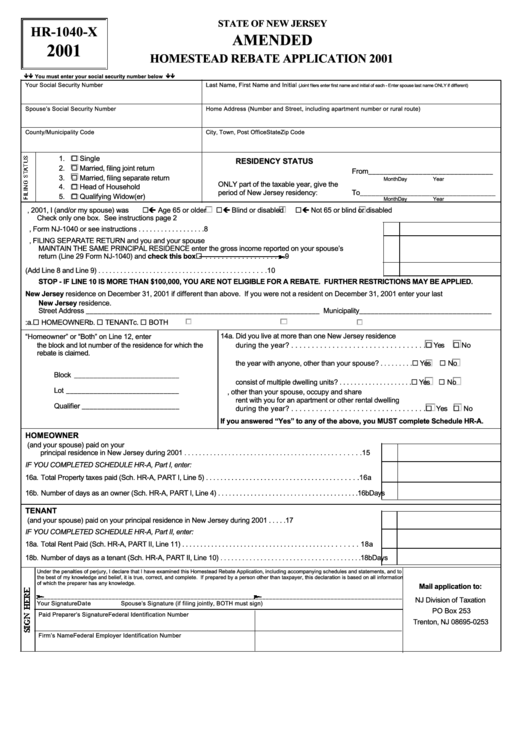

Form Hr-1040-X - Amended Homestead Rebate Application - 2001

ADVERTISEMENT

STATE OF NEW JERSEY

HR-1040-X

AMENDED

2001

HOMESTEAD REBATE APPLICATION 2001

# # You must enter your social security number below # #

Your Social Security Number

Last Name, First Name and Initial

(Joint filers enter first name and initial of each - Enter spouse last name ONLY if different)

Spouse’s Social Security Number

Home Address (Number and Street, including apartment number or rural route)

County/Municipality Code

City, Town, Post Office

State

Zip Code

1. ! Single

RESIDENCY STATUS

2. ! Married, filing joint return

From________________________________

6. If you were a New Jersey resident for

3. ! Married, filing separate return

Month

Day

Year

ONLY part of the taxable year, give the

4. ! Head of Household

period of New Jersey residency:

To___________________________________

5. ! Qualifying Widow(er)

Month

Day

Year

!" Age 65 or older

!" Blind or disabled

!" Not 65 or blind or disabled

7. On December 31, 2001, I (and/or my spouse) was

Check only one box. See instructions page 2

8. Enter the GROSS INCOME you reported on Line 29, Form NJ-1040 or see instructions . . . . . . . . . . . . . . . . . .

8

9. If your filing status is MARRIED, FILING SEPARATE RETURN and you and your spouse

MAINTAIN THE SAME PRINCIPAL RESIDENCE enter the gross income reported on your spouse’s

! . . . . . . . . . . . . . . . . . . . .

return (Line 29 Form NJ-1040) and check this box

9

10. TOTAL GROSS INCOME (Add Line 8 and Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

STOP - IF LINE 10 IS MORE THAN $100,000, YOU ARE NOT ELIGIBLE FOR A REBATE. FURTHER RESTRICTIONS MAY BE APPLIED.

11. Enter your New Jersey residence on December 31, 2001 if different than above. If you were not a resident on December 31, 2001 enter your last

New Jersey residence.

Street Address ____________________________________________________________ Municipality __________________________________

a. ! HOMEOWNER

b. ! TENANT

c. ! BOTH

12. Check your residency status during 2001:

14a. Did you live at more than one New Jersey residence

13. If you checked “Homeowner” or “Both” on Line 12, enter

during the year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ! Yes

! No

the block and lot number of the residence for which the

rebate is claimed.

b. Did you share ownership of a principal residence during

the year with anyone, other than your spouse? . . . . . . . . . ! Yes

! No

c. Did any principal residence you owned during the year

Block ___________________________

consist of multiple dwelling units? . . . . . . . . . . . . . . . . . . . . ! Yes

! No

Lot _____________________________

d. Did anyone, other than your spouse, occupy and share

rent with you for an apartment or other rental dwelling

Qualifier _________________________

during the year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ! Yes ! No

If you answered “Yes” to any of the above, you MUST complete Schedule HR-A.

HOMEOWNER

15. Enter the total 2001 property taxes you (and your spouse) paid on your

principal residence in New Jersey during 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

IF YOU COMPLETED SCHEDULE HR-A, Part I, enter:

16a. Total Property taxes paid (Sch. HR-A, PART I, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16a

16b. Number of days as an owner (Sch. HR-A, PART I, Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16b

Days

TENANT

17. Enter the total rent you (and your spouse) paid on your principal residence in New Jersey during 2001 . . . . . 17

IF YOU COMPLETED SCHEDULE HR-A, Part II, enter:

18a. Total Rent Paid (Sch. HR-A, PART II, Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18a

18b. Number of days as a tenant (Sch. HR-A, PART II, Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18b

Days

Under the penalties of perjury, I declare that I have examined this Homestead Rebate Application, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information

of which the preparer has any knowledge.

Mail application to:

___________________________________________________________________________________________________________

NJ Division of Taxation

Your Signature

Date

Spouse’s Signature (if filing jointly, BOTH must sign)

PO Box 253

Paid Preparer’s Signature

Federal Identification Number

Trenton, NJ 08695-0253

Firm’s Name

Federal Employer Identification Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2