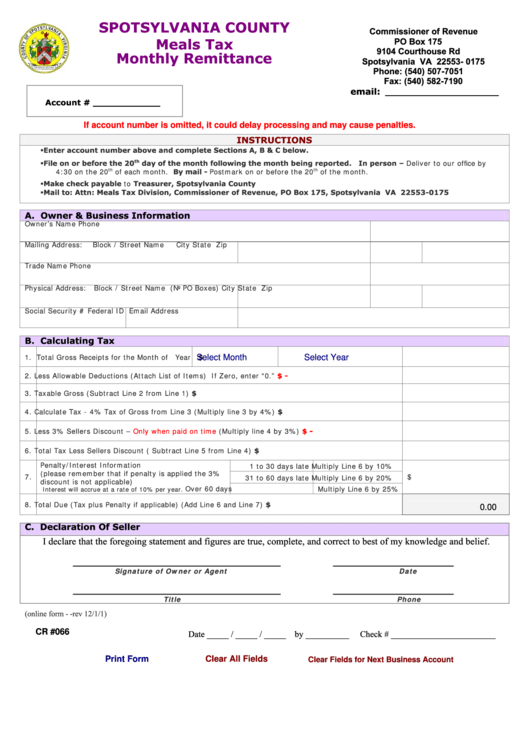

SPOTSYLVANIA COUNTY

Commissioner of Revenue

Meals Tax

PO Box 175

9104 Courthouse Rd

Monthly Remittance

Spotsylvania VA 22553- 0175

Phone: (540) 507-7051

Fax: (540) 582-7190

email: cor@spotsylvania.va.us

Account # ____________

If account number is omitted, it could delay processing and may cause penalties.

INSTRUCTIONS

Enter account number above and complete Sections A, B & C below.

File on or before the 20

th

day of the month following the month being reported. In person – Deliver to our office by

th

of each month. By mail - Postmark on or before the 20

th

4:30 on the 20

of the month.

Make check payable to Treasurer, Spotsylvania County

Mail to: Attn: Meals Tax Division, Commissioner of Revenue, PO Box 175, Spotsylvania VA 22553-0175

A. Owner & Business Information

Owner’s Name

Phone

Mailing Address:

Block / Street Name

City

State

Zip

Trade Name

Phone

Physical Address:

Block / Street Name (No PO Boxes)

City

State

Zip

Social Security #

Federal ID

Email Address

B. Calculating Tax

$

1.

Total Gross Receipts for the Month of

Year

Select Month

Select Year

$ -

2.

Less Allowable Deductions (Attach List of Items) If Zero, enter “0.”

$

3.

Taxable Gross (Subtract Line 2 from Line 1)

$

4.

Calculate Tax - 4% Tax of Gross from Line 3 (Multiply line 3 by 4%)

$ -

5.

Less 3% Sellers Discount –

Only when paid on time

(Multiply line 4 by 3%)

$

6.

Total Tax Less Sellers Discount ( Subtract Line 5 from Line 4)

Penalty/Interest Information

1 to 30 days late

Multiply Line 6 by 10%

(please remember that if penalty is applied the 3%

7.

$

31 to 60 days late

Multiply Line 6 by 20%

discount is not applicable)

Over 60 days

Multiply Line 6 by 25%

Interest will accrue at a rate of 10% per year.

8.

Total Due (Tax plus Penalty if applicable) (Add Line 6 and Line 7)

$

0.00

C. Declaration Of Seller

I declare that the foregoing statement and figures are true, complete, and correct to best of my knowledge and belief.

_______________________________

__________________

Signature of Owner or Agent

Date

_______________________________

__________________

Title

Phone

(online form - -rev 12/1 /1 )

Date _____ / _____ / _____ by __________

Check # ________________________

CR #066

Clear All Fields

Print Form

Clear Fields for Next Business Account

1

1