Request For Irs To Figure Taxable Part Of Annuity - Department Of The Treasury

ADVERTISEMENT

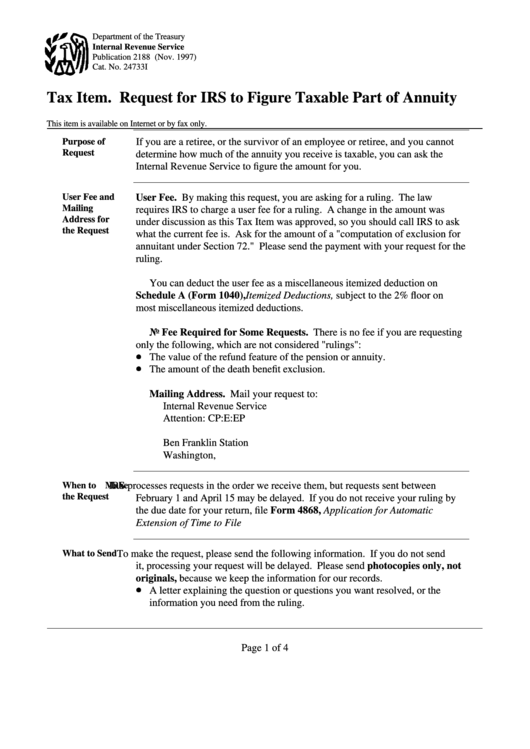

Department of the Treasury

Internal Revenue Service

Publication 2188 (Nov. 1997)

Cat. No. 24733I

Tax Item. Request for IRS to Figure Taxable Part of Annuity

This item is available on Internet or by fax only.

Purpose of

If you are a retiree, or the survivor of an employee or retiree, and you cannot

Request

determine how much of the annuity you receive is taxable, you can ask the

Internal Revenue Service to figure the amount for you.

User Fee and

User Fee. By making this request, you are asking for a ruling. The law

Mailing

requires IRS to charge a user fee for a ruling. A change in the amount was

Address for

under discussion as this Tax Item was approved, so you should call IRS to ask

the Request

what the current fee is. Ask for the amount of a "computation of exclusion for

annuitant under Section 72." Please send the payment with your request for the

ruling.

You can deduct the user fee as a miscellaneous itemized deduction on

Schedule A (Form 1040), Itemized Deductions, subject to the 2% floor on

most miscellaneous itemized deductions.

No Fee Required for Some Requests. There is no fee if you are requesting

only the following, which are not considered "rulings":

The value of the refund feature of the pension or annuity.

The amount of the death benefit exclusion.

Mailing Address. Mail your request to:

Internal Revenue Service

Attention: CP:E:EP

P.O. Box 14073

Ben Franklin Station

Washington, D.C. 20044

When to Make

IRS processes requests in the order we receive them, but requests sent between

the Request

February 1 and April 15 may be delayed. If you do not receive your ruling by

the due date for your return, file Form 4868, Application for Automatic

Extension of Time to File U.S. Individual Income Tax Return.

What to Send

To make the request, please send the following information. If you do not send

it, processing your request will be delayed. Please send photocopies only, not

originals, because we keep the information for our records.

A letter explaining the question or questions you want resolved, or the

information you need from the ruling.

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4