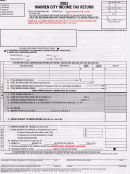

View Instructions

(ATTACH FEDERAL FORMS AND SCHEDULES)

PAGE 2

SECTION A

PROFIT (OR LOSS) FROM BUSINESS OR PROFESSION

SOLE PROPRIETORSHIP

PARTNERSHIP

OR

CORPORATION

1. NET PROFIT (OR LOSS) FROM BUSINESS OR PROFESSION (ATTACH FEDERAL FORMS AND SCHEDULES)

BUSINESS ACTIVITY:

PROFIT $

(IF LOSS

ENTER”0”)

2. TOTAL NET PROFITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

Income from Rents – from Federal Schedule E and R

SECTION B

*If included in Schedule C, Line 5, Kind and Location of Each Property Must Be Shown Below.

Kind & Location of Property

Amount of Rent

Depreciation

Repairs

Other Expenses

Net Income (Or Loss)

NET INCOME (IF LOSS ENTER “0”) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

SECTION C

All Other Taxable Income

INCOME FROM PARTNERSHIPS, ESTATES & TRUSTS, FEES, TIPS, COMMISSIONS, GAMBLING WINNINGS, AND MISCELLANEOUS INCOME (1099 FORM)

RECEIVED FROM

AMOUNT

FOR (DESCRIBE)

TOTAL INCOME (IF LOSS ENTER “0”) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

TOTAL

From Sections A, B & C, Enter on Page 1, Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

SCHEDULE X NOT INTENDED FOR INDIVIDUAL FILERS

SCHEDULE X

RECONCILIATION WITH FEDERAL INCOME TAX RETURN

*FTI= Federal Taxable Income

*ORC= Ohio Revised Code

ADD

ITEMS NOT DEDUCTIBLE

ITEMS NOT TAXABLE

DEDUCT

a. CAPITAL LOSSES (Per ORC Sec. 718.01) . . . . . . . . . . . . . . . . . . . . .$

n. CAPITAL GAINS (Per ORC Sec. 718.01) . . . . . . . . . . . . . . . . . . . . . . .$

b. EXPENSES APPLICABLE TO NON-TAXABLE INCOME . . . . . . . . . . . . . .

(Not less than 5% of Line O)

o. INTANGIBLE INCOME TO THE EXTENT IT IS INCLUDED IN FTI* . . . . . .

c. INCOME TAXES (Federal-State-Municipalities) . . . . . . . . . . . . . . . . . .

p. OTHER (Explain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d. PAYMENTS TO PARTNERS OR COMPENSATION OF OFFICERS, SUB

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CHAPTER S CORPORATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e. CONTRIBUTIONS (in excess of 5% of Net Profits) . . . . . . . . . . . . . . . .

q. TOTAL DEDUCTIONS (ENTER ON LINE 3b Page 1) . . . . . . . . . . . . . . .$

f. OTHER (Explain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g. TOTAL ADDITIONS (ENTER ON LINE 3a Page 1) . . . . . . . . . . . . . . . .$

SCHEDULE Y

BUSINESS ALLOCATION FORMULA

b. LOCATED

a. LOCATED

(b÷a)

IN WARREN

EVERYWHERE

c. PERCENTAGE

STEP 1. ORIGINAL COST OF REAL ESTATE & TANGIBLE PERSONAL PROPERTY

GROSS ANNUAL RENTALS MULTIPLIED BY 8

TOTAL STEP 1

%

STEP 2. WAGES, SALARIES, ETC. PAID

%

STEP 3. GROSS RECEIPTS FROM SALES MADE AND/OR WORK OR SERVICES PERFORMED

%

%

4. TOTAL PERCENTAGES

5. AVERAGE PERCENTAGE (DIVIDE TOTAL PERCENTAGES BY NUMBER OF PERCENTAGES

%

USED – CARRY TO LINE 4c, PAGE 1)

SCHEDULE Z - PARTNERS’ DISTRIBUTIVE SHARES OF NET INCOME

3. DISTRIBUTIVE SHARES

4.

5.

6.

2. RESIDENT

1. NAME AND ADDRESS OF EACH PARTNER

OF PARTNERS

OTHER

TAXABLE

AMOUNT

TAXABLE

PAYMENTS

PERCENTAGE

AMOUNT

YES

NO

PERCENT

$

$

$

(A)

(B)

xxx

xxx

xxxxxxxx

xxxxxxxx

$

7. Totals from Section A and Section B above

100

$

1

1 2

2