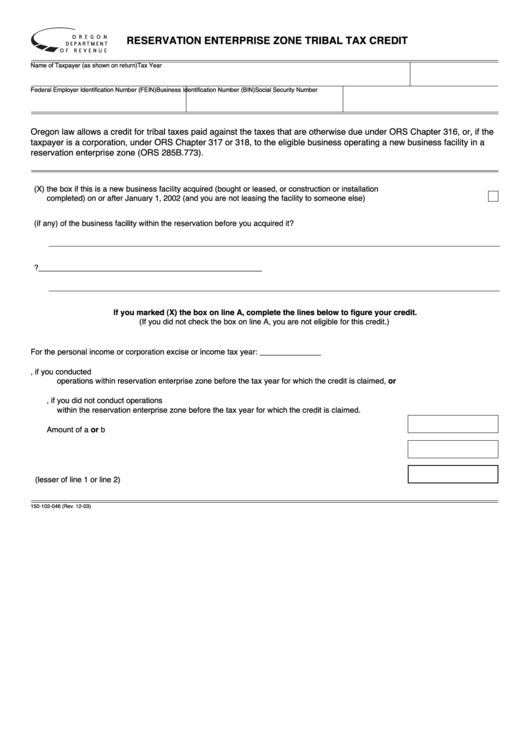

Form 150-102-046 - Reservation Enterprise Zone Tribal Tax Credit - Oregon Department Of Revenue

ADVERTISEMENT

O R E G O N

RESERVATION ENTERPRISE ZONE TRIBAL TAX CREDIT

D E PA R T M E N T

O F R E V E N U E

Name of Taxpayer (as shown on return)

Tax Year

Federal Employer Identification Number (FEIN)

Business Identification Number (BIN)

Social Security Number

Oregon law allows a credit for tribal taxes paid against the taxes that are otherwise due under ORS Chapter 316, or, if the

taxpayer is a corporation, under ORS Chapter 317 or 318, to the eligible business operating a new business facility in a

reservation enterprise zone (ORS 285B.773).

A. Mark (X) the box if this is a new business facility acquired (bought or leased, or construction or installation

completed) on or after January 1, 2002 (and you are not leasing the facility to someone else) .......................................................

B. What was the business activity (if any) of the business facility within the reservation before you acquired it?

_______________________________________________________________________________________________________

C. What is the current business activity of the new business facility? ___________________________________________________

_______________________________________________________________________________________________________

If you marked (X) the box on line A, complete the lines below to figure your credit.

(If you did not check the box on line A, you are not eligible for this credit.)

For the personal income or corporation excise or income tax year: ______________

1.

a. Amount of tribal property tax paid or incurred on the new business facility, if you conducted

operations within reservation enterprise zone before the tax year for which the credit is claimed, or

b. Amount of all tribal taxes paid or incurred by the eligible business, if you did not conduct operations

within the reservation enterprise zone before the tax year for which the credit is claimed.

Amount of a or b ....................................................................................................................................... 1

2. Amount of tax liability for the tax year ....................................................................................................... 2

3. Allowable credit (lesser of line 1 or line 2) ................................................................................................ 3

150-102-046 (Rev. 12-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1