Instructions For Form L-L 120 For Corporations Doing Business In Lapeer

ADVERTISEMENT

l”rumu T:bx Uivision

Lapecr, Ml 40446

Corporationscannot elect to file and be taxed ss partnerships.

*rice.

fdlowing five consecutive years. No deduction will be allowed

nllowed

at.tach

s schedule showing your computation for the amount

sre required to complete Schedule C and report income on line lb

“Sec. 19. The taxpayer may petition for and the ad-

s statement. explaining the manner in which the appor-

ssme extent, and under the bone limitations, ss under the Federal.

s proportionate share of dividends, interest. and other non-

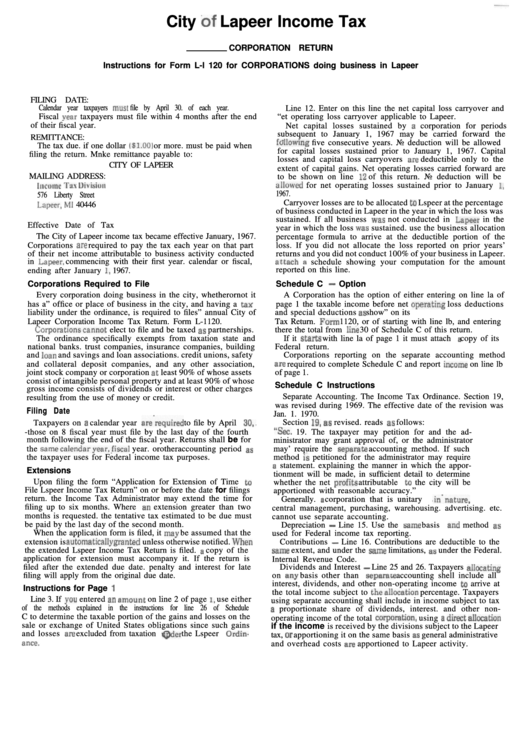

City of Lapeer Income Tax

CORPORATION RETURN

Instructions for Form L-l 120 for CORPORATIONS doing business in Lapeer

FILING DATE:

Calendar year taxpayers must file by April 30. of each year.

Line 12. Enter on this line the net capital loss carryover and

Fiscal year taxpayers must file within 4 months after the end

“et operating loss carryover applicable to Lapeer.

of their fiscal year.

Net capital losses sustained by s corporation for periods

subsequent to January 1, 1967 may be carried forward the

REMITTANCE:

The tax due. if one dollar ($1.00) or more. must be paid when

for capital losses sustained prior to January 1, 1967. Capital

filing the return. Mnke remittance payable to:

losses and capital loss carryovers sre deductible only to the

CITY OF LAPEER

extent of capital gains. Net operating losses carried forward are

MAILING ADDRESS:

to be shown on line I2 of this return. No deduction will be

for net operating losses sustained prior to January I.

1967.

576 Liberty Street

Carryover losses are to be allocated to Lspeer at the percentage

of business conducted in Lapeer in the year in which the loss was

sustained. If all business wss not conducted in Lapeer

in the

Effective Date of Tax

year in which the loss was sustained. use the business allocation

The City of Lapeer income tax became effective January, 1967.

percentage formula to arrive at the deductible portion of the

Corporations sre required to pay the tax each year on that part

loss. If you did not allocate the loss reported on prior years’

of their net income attributable to business activity conducted

returns and you did not conduct 100% of your business in Lapeer.

in Lapser. commencing with their first year. calendar or fiscal,

reported on this line.

ending after January 1. 1967.

Corporations Required to File

Schedule C - Option

Every corporation doing business in the city, whetherornot it

A Corporation has the option of either entering on line la of

has a” office or place of business in the city, and having a tax

page 1 the taxable income before net operating loss deductions

liability under the ordinance, is required to files” annual City of

and special deductions ss show” on its U.S. Corporation Income

Lapeer Corporation Income Tax Return. Form L-1120.

Tax Return. Form 1120, or of starting with line lb, and entering

there the total from line 30 of Schedule C of this return.

The ordinance specifically exempts from taxation state and

If it starts with line la of page 1 it must attach s copy of its

national banks. trust companies, insurance companies, building

Federal return.

and loan and savings and loan associations. credit unions, safety

Corporations reporting on the separate accounting method

and collateral deposit companies, and any other association,

joint stock company or corporation st least 90% of whose assets

of page 1.

consist of intangible personal property and at least 90% of whose

Schedule C Instructions

gross income consists of dividends or interest or other charges

Separate Accounting. The Income Tax Ordinance. Section 19,

resulting from the use of money or credit.

was revised during 1969. The effective date of the revision was

Filing Date

Jan. 1. 1970.

Section 19. ss revised. reads ss follows:

Taxpayers on s calendar year are’required to file by April 30..

-those on 8 fiscal year must file by the last day of the fourth

month following the end of the fiscal year. Returns shall be for

ministrator may grant approval of, or the administrator

the samecalendaryear,firaI

year. orotheraccounting period 8s

may’ require the separate accounting method. If such

the taxpayer uses for Federal income tax purposes.

method ii petitioned for the administrator may require

Extensions

tionment will be made, in sufficient detail to determine

Upon filing the form “Application for Extension of Time to

whether the net profits attributable to the city will be

File Lspeer Income Tax Return” on or before the date for filings

apportioned with reasonable accuracy.”

return. the Income Tax Administrator may extend the time for

Generally. s corporation that is unitary .in’“sture. i.e. has

filing up to six months. Where en extension greater than two

central management, purchasing, warehousing. advertising. etc.

months is requested. the tentative tax estimated to be due must

cannot use separate accounting.

be paid by the last day of the second month.

Depreciation - Line 15. Use the ssme basis and method ss

When the application form is filed, it may be assumed that the

used for Federal income tax reporting.

extension is automaticallygranted unless otherwise notified. When

Contributions - Line 16. Contributions are deductible to the

the extended Lspeer Income Tax Return is filed. s copy of the

application for extension must accompany it. If the return is

Internal Revenue Code.

filed after the extended due date. penalty and interest for late

Dividends and Interest - Line 25 and 26. Taxpayers allocating

filing will apply from the original due date.

on eny basis other than sepamce accounting shell include all

interest, dividends, and other non-operating income to arrive at

Instructions for Page I

the total income subject to theallocation percentage. Taxpayers

Line 3. If you entered s” amount on line 2 of page 1, use either

using separate accounting shall include in income subject to tax

of the methods explained in the instructions for line 26 of Schedule

C to determine the taxable portion of the gains and losses on the

operating income of the total corporation.

using s direct allocation

sale or exchange of United States obligations since such gains

if the income is received by the divisions subject to the Lapeer

and losses sre excluded from taxation @der the Lspeer Ordin.

tax, or apportioning it on the same basis ss general administrative

and overhead costs sre apportioned to Lapeer activity.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2