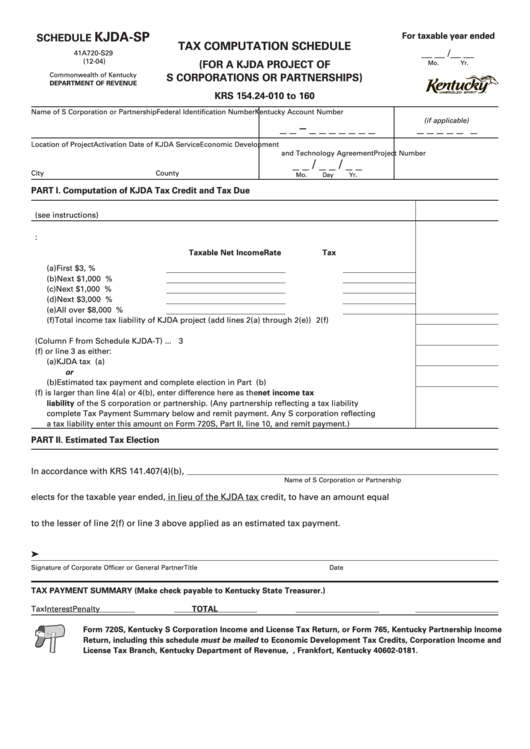

Form 41a720-S29 - Schedule Kjda-Sp - Tax Computation Schedule (For A Kjda Project Of S Corporations Or Partnerships)

ADVERTISEMENT

KJDA-SP

For taxable year ended

SCHEDULE

TAX COMPUTATION SCHEDULE

__ __ / __ __

41A720-S29

(12-04)

Mo.

Yr.

(FOR A KJDA PROJECT OF

Commonwealth of Kentucky

S CORPORATIONS OR PARTNERSHIPS)

DEPARTMENT OF REVENUE

KRS 154.24-010 to 160

Name of S Corporation or Partnership

Federal Identification Number

Kentucky Account Number

(if applicable)

_ _ – _ _ _ _ _ _ _

_ _ _ _ _ _

Location of Project

Activation Date of KJDA Service

Economic Development

and Technology Agreement

Project Number

_ _ / _ _ / _ _

City

County

Mo.

Day

Yr.

PART I. Computation of KJDA Tax Credit and Tax Due

1. Kentucky taxable net income from KJDA project (see instructions) ................................................... 1

2. Compute tax on amount from line 1:

Taxable Net Income

Rate

Tax

(a)

First $3,000 .......................

x

2%

(b)

Next $1,000 ......................

x

3%

(c)

Next $1,000 ......................

x

4%

(d)

Next $3,000 ......................

x

5%

(e)

All over $8,000 .................

x

6%

(f)

Total income tax liability of KJDA project (add lines 2(a) through 2(e)) ................................. 2(f)

3. Limitation (Column F from Schedule KJDA-T) ...................................................................................... 3

4. Enter lesser of line 2(f) or line 3 as either:

(a)

KJDA tax credit ............................................................................................................................. 4(a)

or

(b)

Estimated tax payment and complete election in Part II .......................................................... 4(b)

5. If line 2(f) is larger than line 4(a) or 4(b), enter difference here as the net income tax

liability of the S corporation or partnership. (Any partnership reflecting a tax liability

complete Tax Payment Summary below and remit payment. Any S corporation reflecting

a tax liability enter this amount on Form 720S, Part II, line 10, and remit payment.) ....................... 5

PART II. Estimated Tax Election

In accordance with KRS 141.407(4)(b),

Name of S Corporation or Partnership

elects for the taxable year ended

, in lieu of the KJDA tax credit, to have an amount equal

to the lesser of line 2(f) or line 3 above applied as an estimated tax payment.

Signature of Corporate Officer or General Partner

Title

Date

TAX PAYMENT SUMMARY (Make check payable to Kentucky State Treasurer.)

Tax

Interest

Penalty

TOTAL

Form 720S, Kentucky S Corporation Income and License Tax Return, or Form 765, Kentucky Partnership Income

Return, including this schedule must be mailed to Economic Development Tax Credits, Corporation Income and

License Tax Branch, Kentucky Department of Revenue, P.O. Box 181, Frankfort, Kentucky 40602-0181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1