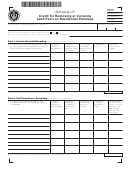

Schedule Lp Draft - Credit For Removing Or Covering Lead Paint On Residential Premises - 2015 Page 3

ADVERTISEMENT

When Does the Taxpayer Become Entitled to

for Taxes Paid to Other Jurisdiction and any other credits you may

be eligible for. These include, but are not limited to: the Energy

the Credit?

Credit, Economic Opportunity Area Credit, Septic Credit, Brown-

You are entitled to claim a Lead Paint Credit in the taxable year in

fields Credit, Low Income Housing Credit, Historic Rehabilitation

which compliance is certified or in the year in which the payment

Credit, Film Incentive Credit, Medical Device Credit, Employer

for the deleading occurs, whichever is later.

Wellness Program Credit and Farming and Fisheries Credit.

You must complete and enclose Schedule LP with your return.

Note: It is more advantageous to use the credit(s) that is going to

Failure to do so will result in this credit being disallowed on your

expire first.

tax return and an adjustment of your reported tax. Taxpayers

must retain a copy of the Letter of Interim Control and/or Letter of

What If My Lead Paint Credit Is Larger Than

Compliance.

My Tax Liability?

What If I Am Taking the Lead Paint Credit and

If the credit you derive from deleading a residential dwelling

amounts to more than the amount you owe in income taxes for

Another Credit On My Tax Return?

the year, the balance may be carried over into the next tax year.

If you are taking another credit in addition to the Lead Paint Credit

You may carry over an unused portion of the original credit for up

on your tax return, you must reduce the amount of tax reported in

to seven years.

line 8 of Schedule LP (from Form 1, line 28 or Form 1-NR/PY, line

32 or Form 2, line 41) by any Limited Income Credit and/or Credit

DRAFT AS OF

SEPTEMBER 25, 2015

(SUBJECT TO CHANGE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3