Form Cpp-1 - Payment Installment Plan Request - Illinois Department Of Revenue

ADVERTISEMENT

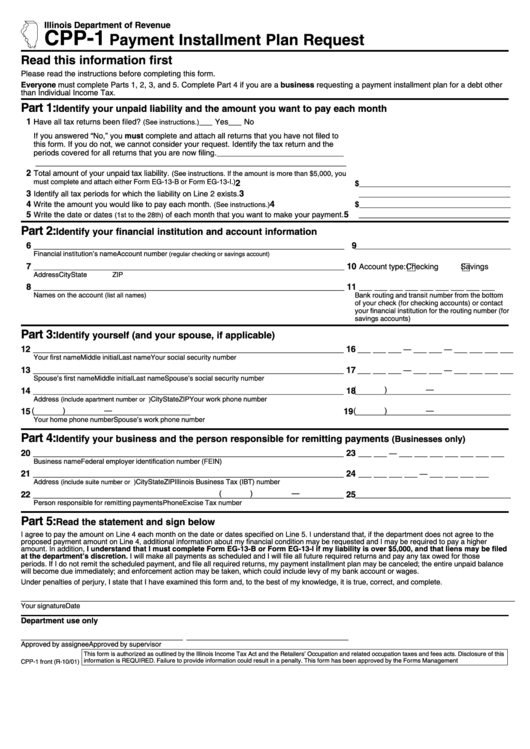

Illinois Department of Revenue

CPP-1

Payment Installment Plan Request

Read this information first

Please read the instructions before completing this form.

Everyone must complete Parts 1, 2, 3, and 5. Complete Part 4 if you are a business requesting a payment installment plan for a debt other

than Individual Income Tax.

Part 1:

Identify your unpaid liability and the amount you want to pay each month

1

Have all tax returns been filed?

___ Yes

___ No

(See instructions.)

If you answered “No,” you must complete and attach all returns that you have not filed to

this form. If you do not, we cannot consider your request. Identify the tax return and the

periods covered for all returns that you are now filing. _____________________________

_______________________________________________________________________

2

Total amount of your unpaid tax liability.

(See instructions. If the amount is more than $5,000, you

must complete and attach either Form EG-13-B or Form EG-13-I.)

2

$___________________________________

3

3

Identify all tax periods for which the liability on Line 2 exists.

___________________________________

4

4

Write the amount you would like to pay each month.

$___________________________________

(See instructions.)

5

5

Write the date or dates

of each month that you want to make your payment.

___________________________________

(1st to the 28th)

Part 2:

Identify your financial institution and account information

6

9

_______________________________________________________________________

____________________________________

Financial institution’s name

Account number

(regular checking or savings account)

7

10

_______________________________________________________________________

Account type:

Checking

Savings

Address

City

State

ZIP

8

11

_______________________________________________________________________

___ ___ ___ ___ ___ ___ ___ ___ ___

Names on the account

Bank routing and transit number from the bottom

(list all names)

of your check (for checking accounts) or contact

your financial institution for the routing number (for

savings accounts)

Part 3:

Identify yourself (and your spouse, if applicable)

12

16

_______________________________________________________________________

___ ___ ___ — ___ ___ — ___ ___ ___ ___

Your first name

Middle initial

Last name

Your social security number

13

17

_______________________________________________________________________

___ ___ ___ — ___ ___ — ___ ___ ___ ___

Spouse’s first name

Middle initial

Last name

Spouse’s social security number

(

)

—

14

18

_______________________________________________________________________

____________________________________

Address

City

State

ZIP

Your work phone number

(include apartment number or P.O. box)

(

)

—

(

)

—

15

19

____________________________________

____________________________________

Your home phone number

Spouse’s work phone number

Part 4:

Identify your business and the person responsible for remitting payments

(Businesses only)

20

23

_______________________________________________________________________

___ ___ — ___ ___ ___ ___ ___ ___ ___

Business name

Federal employer identification number (FEIN)

21

24

_______________________________________________________________________

___ ___ ___ ___ — ___ ___ ___ ___

Address

City

State

ZIP

Illinois Business Tax (IBT) number

(include suite number or P.O. box)

(

)

—

22

25

_______________________________________________________________________

____________________________________

Person responsible for remitting payments

Phone

Excise Tax number

Part 5:

Read the statement and sign below

I agree to pay the amount on Line 4 each month on the date or dates specified on Line 5. I understand that, if the department does not agree to the

proposed payment amount on Line 4, additional information about my financial condition may be requested and I may be required to pay a higher

amount. In addition, I understand that I must complete Form EG-13-B or Form EG-13-I if my liability is over $5,000, and that liens may be filed

at the department’s discretion. I will make all payments as scheduled and I will file all future required returns and pay any tax owed for those

periods. If I do not remit the scheduled payment, and file all required returns, my payment installment plan may be canceled; the entire unpaid balance

will become due immediately; and enforcement action may be taken, which could include levy of my bank account or wages.

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

_____________________________________________________________________________________________________________________

Your signature

Date

Department use only

_____________________________________ _____________________________________

Approved by assignee

Approved by supervisor

This form is authorized as outlined by the Illinois Income Tax Act and the Retailers’ Occupation and related occupation taxes and fees acts. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-4231

CPP-1 front (R-10/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1