Nrc Form 525 - Nrc Form 525 Page 3

Download a blank fillable Nrc Form 525 - Nrc Form 525 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Nrc Form 525 - Nrc Form 525 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

IMPORTANT INSTRUCTIONS FOR NRC FORM 526 -- PLEASE READ CAREFULLY

DO NOT COMPLETE OR RETURN THIS FORM IF YOU DO NOT QUALIFY AS A SMALL ENTITY

(Continued)

CERTIFICATION OF SMALL ENTITY STATUS FOR THE PURPOSES

OF ANNUAL FEES IMPOSED UNDER 10 CFR PART 171

e. If you are a manufacturer, enter your North American Industry Classification System business code

in the narrow, elongated box provided for that purpose under MANUFACTURING INDUSTRY on

Form 526. In accordance with the North American Industry Classification System (NAICS), each

business is assigned a NAICS business code. If you do not know your NAICS business code it can

be obtained on the internet at

f. As used in Form 526, "educational institution" means an entity that has education as its primary

function; that offers programs accredited by a nationally recognized accrediting agency or

association; that is legally authorized to provide a program of organized instruction or study; that

provides an educational program for which it awards academic degrees; and that makes its

educational programs available to the public.

2. If the invoice states the "Amount Billed Represents 50% Proration," the amount due is not the prorated

amount shown on the invoice, but rather one-half of the maximum small entity annual fee shown on NRC

Form 526 for the size standard under which the licensee qualifies (either $2,050 or $425) for each category

billed.

3. If the invoice amount is less than the reduced small entity annual fee shown on this form, pay the amount

on the invoice; there is no further reduction. In this case, do not file NRC Form 526. However, if the invoice

amount is greater than the reduced small entity annual fee, file NRC Form 526 and pay the amount

applicable to the size standard you checked on the form.

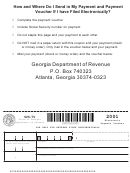

4. The completed NRC Form 526 must be submitted with the required annual fee payment and the "Payment

Copy" of the invoice to the address shown on the invoice.

5. 10 CFR 171.16(c)(3) provides that a licensee must submit a new certification with its annual fee payment

each year. A licensee must pay the full amount of the invoice, if the licensee fails to submit NRC Form 526

at the time the annual fee is paid.

NRC Form 526 can be accessed on the NRC's public website at:

NRC's Small Entity Compliance Guide is available online in the NRC Library at:

From this page, the public can gain entry

into the Agencywide Documents Access and Management System (ADAMS), which

provides text and image files of the NRC's public documents.

To obtain information quickly regarding small entities and annual fees, please contact the

License Fee Billing Help Desk at (301) 415-7554 or by e-mail at:

SmallEntity.Resource@nrc.gov.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3