Form M-1 - Employer Monthly Return Of Withholding Tax - Cincinnati Income Tax Bureau - 2005

ADVERTISEMENT

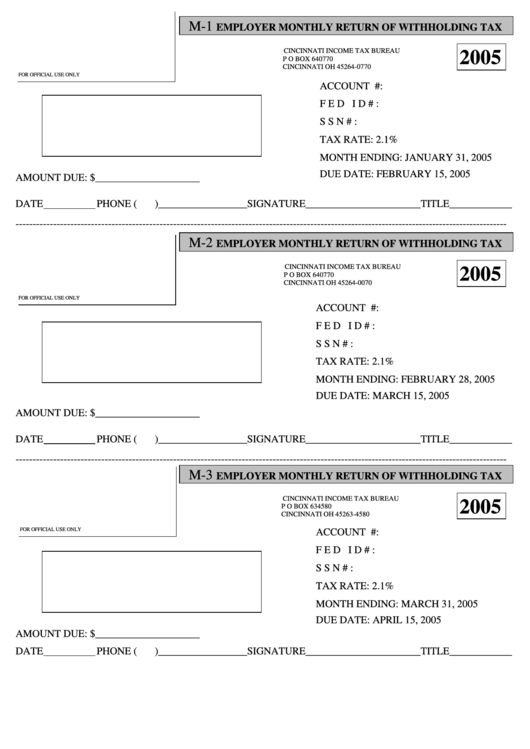

M-1

EMPLOYER MONTHLY RETURN OF WITHHOLDING TAX

CINCINNATI INCOME TAX BUREAU

2005

P O BOX 640770

CINCINNATI OH 45264-0770

FOR OFFICIAL USE ONLY

ACCOUNT #:

FED ID#:

SSN#:

TAX RATE: 2.1%

MONTH ENDING: JANUARY 31, 2005

DUE DATE: FEBRUARY 15, 2005

AMOUNT DUE: $____________________

DATE

PHONE (

)_________________SIGNATURE______________________TITLE____________

------------------------------------------------------------------------------------------------------------------------------------------------

M-2

EMPLOYER MONTHLY RETURN OF WITHHOLDING TAX

CINCINNATI INCOME TAX BUREAU

2005

P O BOX 640770

CINCINNATI OH 45264-0070

FOR OFFICIAL USE ONLY

ACCOUNT #:

FED ID#:

SSN#:

TAX RATE: 2.1%

MONTH ENDING: FEBRUARY 28, 2005

DUE DATE: MARCH 15, 2005

AMOUNT DUE: $____________________

DATE

PHONE (

)_________________SIGNATURE______________________TITLE____________

------------------------------------------------------------------------------------------------------------------------------------------------

M-3

EMPLOYER MONTHLY RETURN OF WITHHOLDING TAX

CINCINNATI INCOME TAX BUREAU

2005

P O BOX 634580

CINCINNATI OH 45263-4580

FOR OFFICIAL USE ONLY

ACCOUNT #:

FED ID#:

SSN#:

TAX RATE: 2.1%

MONTH ENDING: MARCH 31, 2005

DUE DATE: APRIL 15, 2005

AMOUNT DUE: $____________________

DATE

PHONE (

)_________________SIGNATURE______________________TITLE____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4