Form Ct-941x - Amended Connecticut Reconciliation Of Withholding - 2003

ADVERTISEMENT

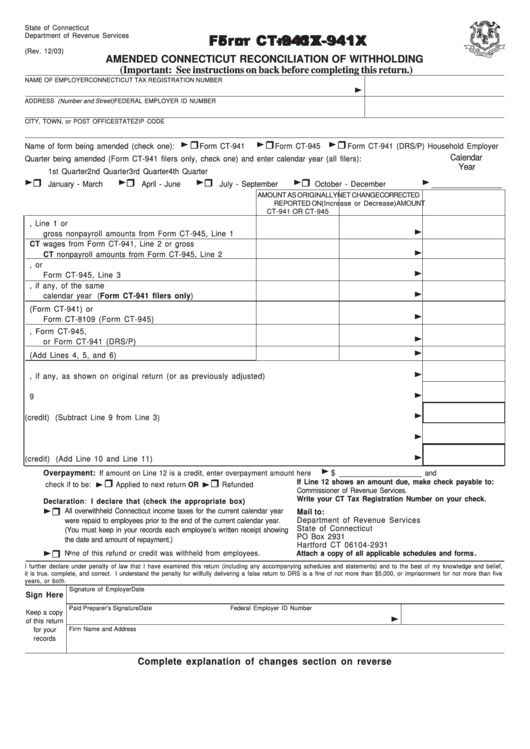

State of Connecticut

F F F F F or

or

or

orm CT

m CT

m CT-941X

m CT

-941X

-941X

-941X

or

m CT

-941X

Department of Revenue Services

(Rev. 12/03)

AMENDED CONNECTICUT RECONCILIATION OF WITHHOLDING

(Important: See instructions on back before completing this return.)

NAME OF EMPLOYER

CONNECTICUT TAX REGISTRATION NUMBER

ADDRESS (Number and Street)

FEDERAL EMPLOYER ID NUMBER

CITY, TOWN, or POST OFFICE

STATE

ZIP CODE

Name of form being amended (check one):

Form CT-941

Form CT-945

Form CT-941 (DRS/P) Household Employer

Calendar

Quarter being amended (Form CT-941 filers only, check one) and enter calendar year (all filers):

Year

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

January - March

April - June

July - September

October - December

_________________

AMOUNT AS ORIGINALLY

NET CHANGE

CORRECTED

REPORTED ON

(Increase or Decrease)

AMOUNT

CT-941 OR CT-945

1. Enter gross wages from Form CT-941, Line 1 or

gross nonpayroll amounts from Form CT-945, Line 1 ...... 1

2. Enter gross CT wages from Form CT-941, Line 2 or gross

CT nonpayroll amounts from Form CT-945, Line 2 ........... 2

3. Enter CT tax withheld from Form CT-941, or

Form CT-945, Line 3 ............................................................ 3

4. Enter credit from prior quarter, if any, of the same

calendar year (Form CT-941 filers only) ......................... 4

5. Deposits made with Form CT-WH (Form CT-941) or

Form CT-8109 (Form CT-945) ............................................. 5

6. Amount paid with Form CT-941, Form CT-945,

or Form CT-941 (DRS/P) ...................................................... 6

7. Total payments (Add Lines 4, 5, and 6) ............................ 7

8. Overpayment, if any, as shown on original return (or as previously adjusted) ...................................... 8

9. Subtract Line 8 from Line 7 ............................................................................................................................... 9

10. Net tax due or (credit) (Subtract Line 9 from Line 3) ................................................................................. 1 0

11. Interest on net tax due ...................................................................................................................................... 11

12. Total amount due or (credit) (Add Line 10 and Line 11) ........................................................................... 1 2

Overpayment:

$ ____________________

If amount on Line 12 is a credit, enter overpayment amount here

and

If Line 12 shows an amount due, make check payable to:

check if to be:

Applied to next return OR

Refunded

Commissioner of Revenue Services.

Write your CT Tax Registration Number on your check.

Declaration: I declare that (check the appropriate box)

All overwithheld Connecticut income taxes for the current calendar year

Mail to:

Department of Revenue Services

were repaid to employees prior to the end of the current calendar year.

State of Connecticut

(You must keep in your records each employee’s written receipt showing

PO Box 2931

the date and amount of repayment.)

Hartford CT 06104-2931

None of this refund or credit was withheld from employees.

Attach a copy of all applicable schedules and forms.

I further declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and to the best of my knowledge and belief,

it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more than five

years, or both.

Signature of Employer

Date

Sign Here

Paid Preparer’s Signature

Date

Federal Employer ID Number

Keep a copy

of this return

Firm Name and Address

for your

records

Complete explanation of changes section on reverse

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2