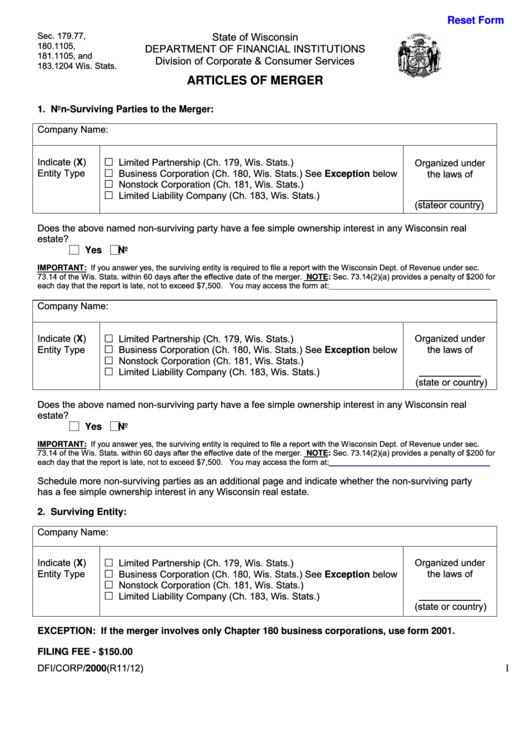

Reset Form

Sec. 179.77,

State of Wisconsin

180.1105,

DEPARTMENT OF FINANCIAL INSTITUTIONS

181.1105, and

Division of Corporate & Consumer Services

183.1204 Wis. Stats.

ARTICLES OF MERGER

1. Non-Surviving Parties to the Merger:

Company Name:

Indicate (X)

Limited Partnership (Ch. 179, Wis. Stats.)

Organized under

Entity Type

Business Corporation (Ch. 180, Wis. Stats.) See Exception below

the laws of

Nonstock Corporation (Ch. 181, Wis. Stats.)

Limited Liability Company (Ch. 183, Wis. Stats.)

____________

(state or country)

Does the above named non-surviving party have a fee simple ownership interest in any Wisconsin real

estate?

Yes

No

IMPORTANT: If you answer yes, the surviving entity is required to file a report with the Wisconsin Dept. of Revenue under sec.

73.14 of the Wis. Stats. within 60 days after the effective date of the merger. NOTE: Sec. 73.14(2)(a) provides a penalty of $200 for

each day that the report is late, not to exceed $7,500. You may access the form at:

Company Name:

Indicate (X)

Limited Partnership (Ch. 179, Wis. Stats.)

Organized under

Entity Type

Business Corporation (Ch. 180, Wis. Stats.) See Exception below

the laws of

Nonstock Corporation (Ch. 181, Wis. Stats.)

Limited Liability Company (Ch. 183, Wis. Stats.)

(state or country)

Does the above named non-surviving party have a fee simple ownership interest in any Wisconsin real

estate?

Yes

No

IMPORTANT: If you answer yes, the surviving entity is required to file a report with the Wisconsin Dept. of Revenue under sec.

73.14 of the Wis. Stats. within 60 days after the effective date of the merger. NOTE: Sec. 73.14(2)(a) provides a penalty of $200 for

each day that the report is late, not to exceed $7,500. You may access the form at:

Schedule more non-surviving parties as an additional page and indicate whether the non-surviving party

has a fee simple ownership interest in any Wisconsin real estate.

2. Surviving Entity:

Company Name:

Indicate (X)

Limited Partnership (Ch. 179, Wis. Stats.)

Organized under

Entity Type

the laws of

Business Corporation (Ch. 180, Wis. Stats.) See Exception below

Nonstock Corporation (Ch. 181, Wis. Stats.)

Limited Liability Company (Ch. 183, Wis. Stats.)

(state or country)

EXCEPTION: If the merger involves only Chapter 180 business corporations, use form 2001.

FILING FEE - $150.00

1

DFI/CORP/2000(R11/12)

1

1 2

2 3

3 4

4 5

5