Instructions For Completion Of Common And Contract Petroleum Products Carrier (Transporter) Return And Applicable Schedules - Form 1301 Page 2

ADVERTISEMENT

Form Gas 1301 Instr. (Reverse)

(Rev. 6/98)

(Web)

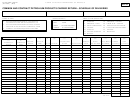

Column (11):

Document Number – Enter the identifying number from the document issued at the

terminal when product is removed over the rack. In the case of pipeline or barge

movements, enter the pipeline or barge ticket number.

Columns (12) & (13):

Gallons – Enter the number of gross and net gallons delivered for each delivery.

SUMMARY OF DELIVERIES

Page 1

Line 1 – Total Gallons of Petroleum Products Loaded at a North Carolina Terminal or Bulk Plant and deliv-

ered to another state – Add total gallons on each Schedule 1A and enter the total net gallons.

Line 2 – Total Gallons of Petroleum Products Loaded at an Out–of–State Terminal or Bulk Plant and deliv-

ered into North Carolina – Add total gallons on each Schedule 2A and enter the total net gallons.

Line 3 – Total Gallons of Petroleum Products Loaded at a North Carolina Terminal or Bulk Plant and deliv-

ered within North Carolina – Add total gallons on each Schedule 1A and enter the total net gallons. THIS

SCHEDULE IS NOT REQUIRED AT THIS TIME.

Penalty – G.S. 105–236(10)(c) – Failure to file an informational return when due. Add a penalty of $50.00

If you have any questions concerning this return or you have any other Motor Fuels Tax questions, you may contact

the Motor Fuels Tax Division at (919) 733–3409.

Sign, date and mail return to the North Carolina Department of Revenue, Motor Fuels Tax Division, P O Box 25000,

Raleigh NC 27640.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2