Form 500mc Instructions - Report Of Maryland Multistate Manufacturing Corporation - 2002

ADVERTISEMENT

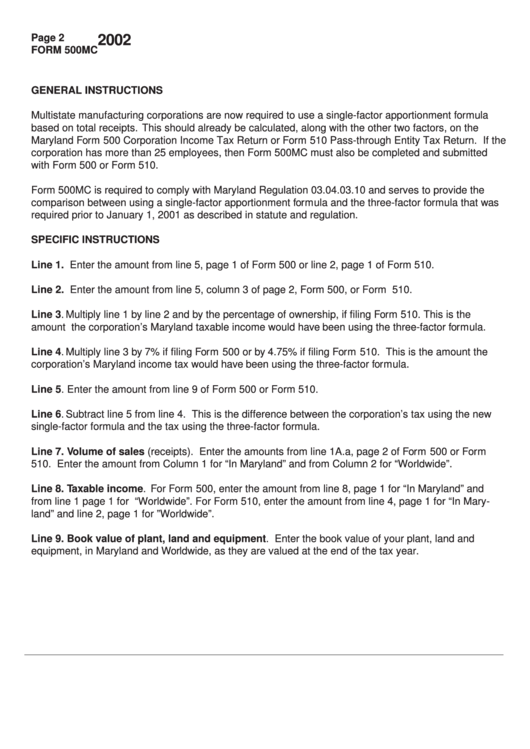

Page 2

2002

FORM 500MC

GENERAL INSTRUCTIONS

Multistate manufacturing corporations are now required to use a single-factor apportionment formula

based on total receipts. This should already be calculated, along with the other two factors, on the

Maryland Form 500 Corporation Income Tax Return or Form 510 Pass-through Entity Tax Return. If the

corporation has more than 25 employees, then Form 500MC must also be completed and submitted

with Form 500 or Form 510.

Form 500MC is required to comply with Maryland Regulation 03.04.03.10 and serves to provide the

comparison between using a single-factor apportionment formula and the three-factor formula that was

required prior to January 1, 2001 as described in statute and regulation.

SPECIFIC INSTRUCTIONS

Line 1. Enter the amount from line 5, page 1 of Form 500 or line 2, page 1 of Form 510.

Line 2. Enter the amount from line 5, column 3 of page 2, Form 500, or Form 510.

Line 3. Multiply line 1 by line 2 and by the percentage of ownership, if filing Form 510. This is the

amount the corporation’s Maryland taxable income would have been using the three-factor formula.

Line 4. Multiply line 3 by 7% if filing Form 500 or by 4.75% if filing Form 510. This is the amount the

corporation’s Maryland income tax would have been using the three-factor formula.

Line 5. Enter the amount from line 9 of Form 500 or Form 510.

Line 6. Subtract line 5 from line 4. This is the difference between the corporation’s tax using the new

single-factor formula and the tax using the three-factor formula.

Line 7. Volume of sales (receipts). Enter the amounts from line 1A.a, page 2 of Form 500 or Form

510. Enter the amount from Column 1 for “In Maryland” and from Column 2 for “Worldwide”.

Line 8. Taxable income. For Form 500, enter the amount from line 8, page 1 for “In Maryland” and

from line 1 page 1 for “Worldwide”. For Form 510, enter the amount from line 4, page 1 for “In Mary-

land” and line 2, page 1 for ”Worldwide”.

Line 9. Book value of plant, land and equipment. Enter the book value of your plant, land and

equipment, in Maryland and Worldwide, as they are valued at the end of the tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1