Irs Publication 1494 - 2012

ADVERTISEMENT

1.

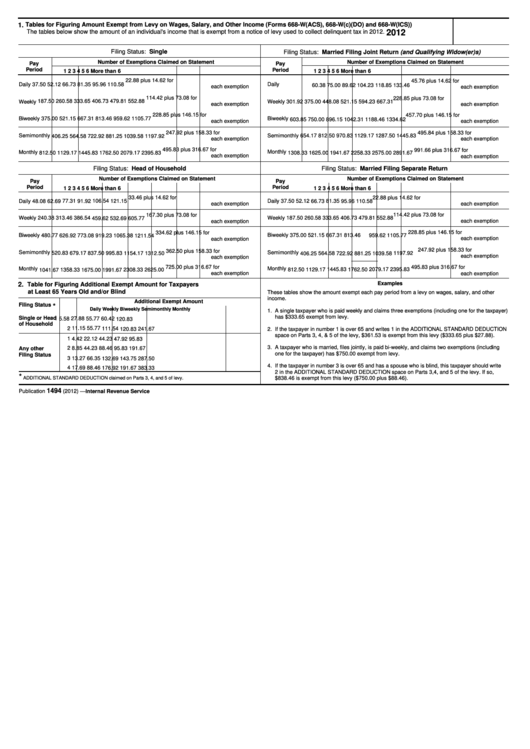

Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income (Forms 668-W(ACS), 668-W(c)(DO) and 668-W(ICS))

2012

The tables below show the amount of an individual's income that is exempt from a notice of levy used to collect delinquent tax in 2012.

Filing Status: Single

Filing Status: Married Filing Joint Return (and Qualifying Widow(er)s)

Number of Exemptions Claimed on Statement

Number of Exemptions Claimed on Statement

Pay

Pay

Period

Period

1

2

3

4

5

6

More than 6

1

2

3

4

5

6

More than 6

22.88 plus 14.62 for

45.76 plus 14.62 for

Daily

Daily

37.50

52.12

66.73

81.35

95.96

110.58

60.38

75.00

89.62

104.23

118.85

133.46

each exemption

each exemption

114.42 plus 73.08 for

228.85 plus 73.08 for

187.50

260.58

333.65

406.73

479.81

552.88

Weekly

301.92

375.00

448.08

521.15

594.23

667.31

Weekly

each exemption

each exemption

228.85 plus 146.15 for

457.70 plus 146.15 for

Biweekly

Biweekly

375.00

521.15

667.31

813.46

959.62 1105.77

603.85

750.00

896.15 1042.31 1188.46 1334.62

each exemption

each exemption

247.92 plus 158.33 for

495.84 plus 158.33 for

Semimonthly

Semimonthly

654.17

812.50

970.83 1129.17 1287.50 1445.83

406.25

564.58

722.92

881.25 1039.58 1197.92

each exemption

each exemption

495.83 plus 316.67 for

991.66 plus 316.67 for

Monthly

Monthly

812.50 1129.17

1445.83 1762.50 2079.17 2395.83

1308.33 1625.00 1941.67 2258.33 2575.00 2891.67

each exemption

each exemption

Filing Status: Head of Household

Filing Status: Married Filing Separate Return

Number of Exemptions Claimed on Statement

Number of Exemptions Claimed on Statement

Pay

Pay

Period

Period

1

2

3

4

5

6

More than 6

1

2

3

4

5

6

More than 6

33.46 plus 14.62 for

22.88 plus 14.62 for

Daily

48.08

77.31

91.92

106.54

121.15

Daily

37.50

52.12

66.73

81.35

95.96

110.58

62.69

each exemption

each exemption

114.42 plus 73.08 for

167.30 plus 73.08 for

240.38

187.50

260.58

333.65

406.73

479.81

552.88

Weekly

313.46

386.54

459.62

532.69

605.77

Weekly

each exemption

each exemption

228.85 plus 146.15 for

334.62 plus 146.15 for

Biweekly

480.77

Biweekly

375.00

521.15

667.31

813.46

959.62 1105.77

626.92

773.08

919.23 1065.38 1211.54

each exemption

each exemption

247.92 plus 158.33 for

362.50 plus 158.33 for

Semimonthly

Semimonthly

520.83

679.17

837.50

995.83 1154.17 1312.50

564.58

722.92

881.25

1039.58 1197.92

406.25

each exemption

each exemption

725.00 plus 316.67 for

1445.83 1762.50 2079.17 2395.83 495.83 plus 316.67 for

Monthly

Monthly

1041.67 1358.33

1675.00 1991.67 2308.33 2625.00

812.50 1129.17

each exemption

each exemption

Examples

2.

Table for Figuring Additional Exempt Amount for Taxpayers

at Least 65 Years Old and/or Blind

These tables show the amount exempt each pay period from a levy on wages, salary, and other

income.

Additional Exempt Amount

Filing Status

*

Monthly

Daily

Weekly

Biweekly

Semimonthly

1. A single taxpayer who is paid weekly and claims three exemptions (including one for the taxpayer)

has $333.65 exempt from levy.

Single or Head

1

5.58

27.88

55.77

60.42

120.83

of Household

2

11.15

55.77

111.54

241.67

120.83

2. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD DEDUCTION

space on Parts 3, 4, & 5 of the levy, $361.53 is exempt from this levy ($333.65 plus $27.88).

1

4.42

22.12

44.23

47.92

95.83

3. A taxpayer who is married, files jointly, is paid bi-weekly, and claims two exemptions (including

Any other

2

8.85

44.23

88.46

95.83

191.67

one for the taxpayer) has $750.00 exempt from levy.

Filing Status

3

13.27

66.35

132.69

143.75

287.50

4. If the taxpayer in number 3 is over 65 and has a spouse who is blind, this taxpayer should write

4

17.69

88.46

176.92

191.67

383.33

2 in the ADDITIONAL STANDARD DEDUCTION space on Parts 3,4, and 5 of the levy. If so,

*

ADDITIONAL STANDARD DEDUCTION claimed on Parts 3, 4, and 5 of levy.

$838.46 is exempt from this levy ($750.00 plus $88.46).

1494

Publication

(2012)

Catalog Number 11439T

Department of the Treasury — Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1