Application For Extension - City Of Big Rapids

ADVERTISEMENT

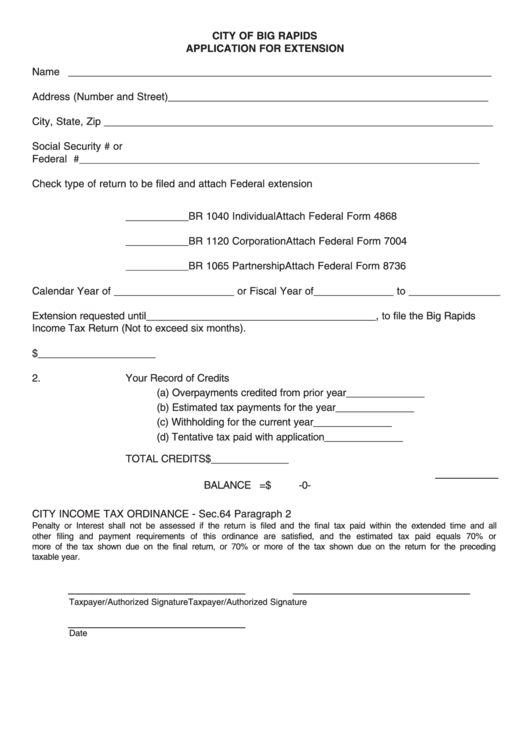

CITY OF BIG RAPIDS

APPLICATION FOR EXTENSION

Name __________________________________________________________________________

Address (Number and Street) ________________________________________________________

City, State, Zip ____________________________________________________________________

Social Security # or

Federal I.D.#______________________________________________________________________

Check type of return to be filed and attach Federal extension

___________BR 1040 Individual

Attach Federal Form 4868

___________BR 1120 Corporation Attach Federal Form 7004

___________BR 1065 Partnership Attach Federal Form 8736

Calendar Year of _____________________ or Fiscal Year of______________ to ________________

Extension requested until_________________________________________, to file the Big Rapids

Income Tax Return (Not to exceed six months).

1.

Your Tax Liability $_____________________

2.

Your Record of Credits

(a) Overpayments credited from prior year ______________

(b) Estimated tax payments for the year

______________

(c) Withholding for the current year

______________

(d) Tentative tax paid with application

______________

TOTAL CREDITS

$______________

BALANCE =

$

-0-

CITY INCOME TAX ORDINANCE - Sec. 64 Paragraph 2

Penalty or Interest shall not be assessed if the return is filed and the final tax paid within the extended time and all

other filing and payment requirements of this ordinance are satisfied, and the estimated tax paid equals 70% or

more of the tax shown due on the final return, or 70% or more of the tax shown due on the return for the preceding

taxable year.

Taxpayer/Authorized Signature

Taxpayer/Authorized Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1