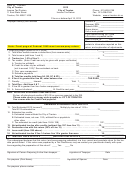

You are eligible to file City of Perrysburg Form EZ or E-File at

if you

Had only W-2 income

•

Lived in Perrysburg the entire year

•

Do not use the City of Perrysburg Form EZ or E-File if you:

Had S corporation, Partnership, Rental, Farm, or other Business income

•

Had taxable 1099-Misc or 1099-C income

•

Filed for a non-resident refund from another city for the 2012 tax year

•

Claimed IRS Form 2106 expenses as a deduction

•

Call City of Perrysburg Tax Office at 419.872.8035 if you have questions.

CALCULATION OF OTHER CITY WITHHOLDING TAX CREDIT

Tax M unicipalities

Call our office or search on

at columbustax.net for tax rate of other Ohio cities.

1. Determine the rate of withholding for the city in which you work, then complete the table below. This table assumes taypayer is fully

withheld in the work city.

A

B

W-2 Box 18

Other

50% of

wages for

Tax paid to

city tax

Perrysburg

Lower

lower

City

other city

other city

rate

tax rate

rate

rate

A X B = credit

%

1.5%

%

1.5%

%

1.5%

2. Total credit for taxes paid all other cities (Transfer to line 2C on front)

Example of calculation:

A

B

W-2 Box 18

Other

50% of

wages for

Tax paid to

city tax

Perrysburg

Lower

lower

City

other city

other city

rate

tax rate

rate

rate

A X B = credit

Walbridge

10,000.00

$150.00

1.5%

1.5%

1.5%

.75%

$75.00

Toledo

7,000.00

$157.50

2.25%

1.5%

1.5%

.75%

$52.50

Wauseon

5,000.00

$50.00

1.0%

1.5%

1.0%

.05%

$25.00

TOTAL OTHER CITY CREDIT

$152.50

IRS: 800.829.1040

State and School Income Tax

Perrysburg Residency questions

Form request: 800.829.3676

Form request: 800.282.1782

Wood County Auditor: 866.860.4140

Web address:

Web address:

Web address:

1

1 2

2