Form St-28b - Statement For Sales Tax Exemption On Electricity, Gas, Or Water Furnished Through One Meter

ADVERTISEMENT

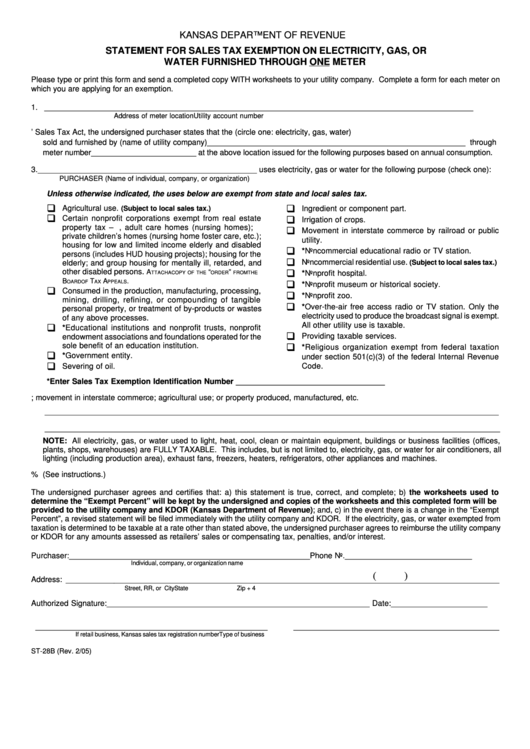

KANSAS DEPARTMENT OF REVENUE

STATEMENT FOR SALES TAX EXEMPTION ON ELECTRICITY, GAS, OR

WATER FURNISHED THROUGH ONE METER

Please type or print this form and send a completed copy WITH worksheets to your utility company. Complete a form for each meter on

which you are applying for an exemption.

1. ___________________________________________________

_______________________________________________

Address of meter location

Utility account number

2. In accordance with the Kansas Retailers’ Sales Tax Act, the undersigned purchaser states that the (circle one: electricity, gas, water)

sold and furnished by (name of utility company) ___________________________________________________________ through

meter number ________________________ at the above location issued for the following purposes based on annual consumption.

3. __________________________________________________ uses electricity, gas or water for the following purpose (check one):

PURCHASER (Name of individual, company, or organization)

Unless otherwise indicated, the uses below are exempt from state and local sales tax.

G

G

Agricultural use.

(Subject to local sales tax.)

Ingredient or component part.

G

G

Certain nonprofit corporations exempt from real estate

Irrigation of crops.

property tax – i.e., adult care homes (nursing homes);

G

Movement in interstate commerce by railroad or public

private children’s homes (nursing home foster care, etc.);

utility.

housing for low and limited income elderly and disabled

G

*Noncommercial educational radio or TV station.

persons (includes HUD housing projects); housing for the

G

Noncommercial residential use.

elderly; and group housing for mentally ill, retarded, and

(Subject to local sales tax.)

G

other disabled persons.

A

“

”

*Nonprofit hospital.

TTACH A COPY OF THE

ORDER

FROM THE

B

T

A

.

G

OARD OF

AX

PPEALS

*Nonprofit museum or historical society.

G

Consumed in the production, manufacturing, processing,

G

*Nonprofit zoo.

mining, drilling, refining, or compounding of tangible

G

*Over-the-air free access radio or TV station. Only the

personal property, or treatment of by-products or wastes

electricity used to produce the broadcast signal is exempt.

of any above processes.

G

All other utility use is taxable.

*Educational institutions and nonprofit trusts, nonprofit

G

Providing taxable services.

endowment associations and foundations operated for the

G

sole benefit of an education institution.

*Religious organization exempt from federal taxation

G

*Government entity.

under section 501(c)(3) of the federal Internal Revenue

G

Code.

Severing of oil.

*Enter Sales Tax Exemption Identification Number __________________________________

4. Describe the taxable service; movement in interstate commerce; agricultural use; or property produced, manufactured, etc.

_____________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________

NOTE: All electricity, gas, or water used to light, heat, cool, clean or maintain equipment, buildings or business facilities (offices,

plants, shops, warehouses) are FULLY TAXABLE. This includes, but is not limited to, electricity, gas, or water for air conditioners, all

lighting (including production area), exhaust fans, freezers, heaters, refrigerators, other appliances and machines.

5. EXEMPT PERCENT

___________ % (See instructions.)

The undersigned purchaser agrees and certifies that: a) this statement is true, correct, and complete; b) the worksheets used to

determine the “Exempt Percent” will be kept by the undersigned and copies of the worksheets and this completed form will be

provided to the utility company and KDOR (Kansas Department of Revenue); and, c) in the event there is a change in the “Exempt

Percent”, a revised statement will be filed immediately with the utility company and KDOR. If the electricity, gas, or water exempted from

taxation is determined to be taxable at a rate other than stated above, the undersigned purchaser agrees to reimburse the utility company

or KDOR for any amounts assessed as retailers’ sales or compensating tax, penalties, and/or interest.

Purchaser: _______________________________________________________

Phone No. _____________________________

Individual, company, or organization name

(

)

Address: ___________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

Authorized Signature: ____________________________________________________________ Date: ______________________

_____________________________________________________

_______________________________________________

If retail business, Kansas sales tax registration number

Type of business

ST-28B (Rev. 2/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2