Application For Income Tax Refund - City Of Lorain Income Tax Division

ADVERTISEMENT

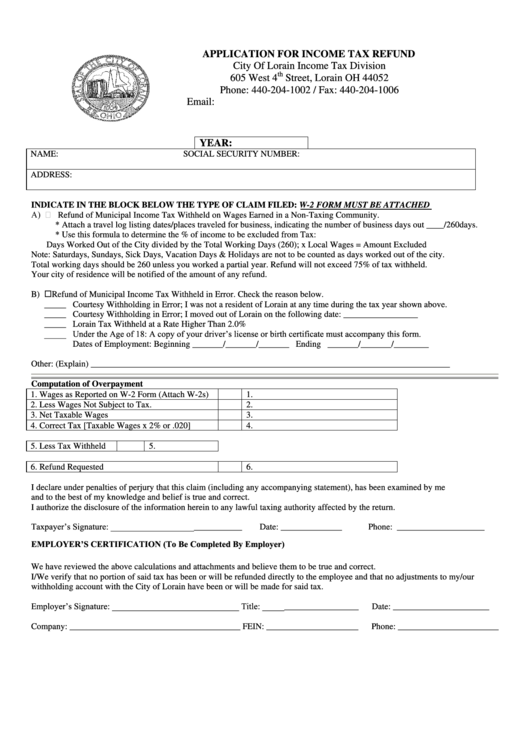

APPLICATION FOR INCOME TAX REFUND

City Of Lorain Income Tax Division

th

605 West 4

Street, Lorain OH 44052

Phone: 440-204-1002 / Fax: 440-204-1006

Email:

Web:

YEAR:

NAME:

SOCIAL SECURITY NUMBER:

ADDRESS:

INDICATE IN THE BLOCK BELOW THE TYPE OF CLAIM FILED: W-2 FORM MUST BE ATTACHED

Refund of Municipal Income Tax Withheld on Wages Earned in a Non-Taxing Community.

* Attach a travel log listing dates/places traveled for business, indicating the number of business days out ____/260days.

* Use this formula to determine the % of income to be excluded from Tax:

Days Worked Out of the City divided by the Total Working Days (260); x Local Wages = Amount Excluded

Note: Saturdays, Sundays, Sick Days, Vacation Days & Holidays are not to be counted as days worked out of the city.

Total working days should be 260 unless you worked a partial year. Refund will not exceed 75% of tax withheld.

Your city of residence will be notified of the amount of any refund.

B) Refund of Municipal Income Tax Withheld in Error. Check the reason below.

_____ Courtesy Withholding in Error; I was not a resident of Lorain at any time during the tax year shown above.

_____ Courtesy Withholding in Error; I moved out of Lorain on the following date: _________________

_____ Lorain Tax Withheld at a Rate Higher Than 2.0%

_____ Under the Age of 18: A copy of your driver’s license or birth certificate must accompany this form.

Dates of Employment: Beginning _______/_______/_______ Ending _______/_______/________

Other: (Explain) __________________________________________________________________________________

Computation of Overpayment

1. Wages as Reported on W-2 Form (Attach W-2s)

1.

2. Less Wages Not Subject to Tax.

2.

3. Net Taxable Wages

3.

4. Correct Tax [Taxable Wages x 2% or .020]

4.

5. Less Tax Withheld

5.

6. Refund Requested

6.

I declare under penalties of perjury that this claim (including any accompanying statement), has been examined by me

and to the best of my knowledge and belief is true and correct.

I authorize the disclosure of the information herein to any lawful taxing authority affected by the return.

Taxpayer’s Signature: ______________________________

Date: ______________

Phone: ____________________

EMPLOYER’S CERTIFICATION (To Be Completed By Employer)

We have reviewed the above calculations and attachments and believe them to be true and correct.

I/We verify that no portion of said tax has been or will be refunded directly to the employee and that no adjustments to my/our

withholding account with the City of Lorain have been or will be made for said tax.

Employer’s Signature: _____________________________ Title: ______________________

Date: ______________________

Company: _______________________________________ FEIN: _____________________

Phone: _______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1