ARKANSAS ANNUAL FRANCHISE TAX REPORT – Corporation

DUE ON OR BEFORE MAY 1

Business and Commercial Services, P.O. Box 8014, Little Rock, Arkansas 72203

Mail Payment To:

Online Filing, Payment, and Information:

Phone: 501-682-3409 or Toll Free: 888-233-0325

WHO FILES ANNUAL FRANCHISE TAX REPORTS: All domestic and foreign corporations, associations,

organizations, and companies constituting a separate legal entity of relationship with the purpose of

obtaining a privilege or franchise which is not allowed to them as individuals except those exempted by

A.C.A. § 26-54-102. The only exemptions are nonprofit corporations, which are organizations exempt from

the federal income tax, or organizations formed pursuant to the Uniform Partnership Act, A.C.A. § 4-46-

101 et seq., or the Uniform Limited Partnership Act, A.C.A. § 4-47-101 et seq.

Business Name and Address: The domestic corporation’s name as it appears in the Articles of

1.

Incorporation or the foreign corporation’s name as it appears in the Application for Certificate of Authority.

DOMESTIC CORPORATION: A corporation that has filed its original Articles of Incorporation in

a)

Arkansas.

FOREIGN CORPORATION: A corporation that has filed its original articles of incorporation anywhere

b)

other than Arkansas and has qualified to receive a Certificate of Authority in Arkansas.

Tax Contact Name, Address, and Contact Information: Person or firm designated to receive the

2.

corporation’s annual franchise tax reporting notifications. Please provide a name, address, phone number,

and email address.

RESPONSIBILITY: Corporations not receiving a form by March 20 must make a written request for

a)

paper forms. Fillable PDF forms can be downloaded, or franchise taxes can be filed online, through

the Secretary of State’s website at . All corporations must comply with the

May 1 due date.

REPORTING YEAR: The year in which the report is due.

b)

TAX YEAR: The year ending December 31 preceding the reporting year.

c)

TAX COMPUTED IN ERROR: Underpayment will be billed to the corporation. Requests for refunds

d)

must be submitted with proof to the Secretary of State's Business and Commercial Services Division

at the above address.

EXTENSIONS: Acts 1046 and 1140 of 1991 eliminated the opportunity to request an extension. ALL

e)

REPORTS ARE DUE ON OR BEFORE MAY 1.

FAILURE TO FILE REPORT: Per A.C.A. § 26-54-107 and 114, corporations shall pay an additional

f)

penalty plus interest for late filing of the report or late payment of the tax. In order to be considered

timely, tax reports and payments must be received by the Secretary of State's office no later than

the close of business on May 1 or must be postmarked by the United States Postal Service no later

than midnight on May 1. Postage meter dates are not acceptable for the purpose of determining the

timely receipt of a tax form and/or payment. See A.C.A. § 26-18-105.

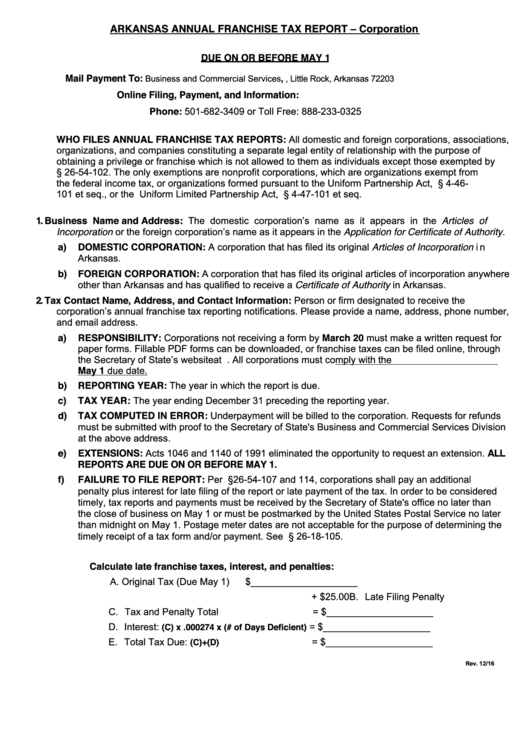

Calculate late franchise taxes, interest, and penalties:

A. Original Tax (Due May 1)

$____________________

Late Filing Penalty

+ $25.00

Tax and Penalty otal

= $____________________

D. Interest:

= $____________________

(C) x .000274 x (# of Days Deficient)

E. Total Tax Due:

= $____________________

(C)+(D)

Rev. 1 /1

1

1 2

2