Board And Commission Members Financial Disclosure Statement Instructions (Form 2) - Maryland State Ethics Commission

ADVERTISEMENT

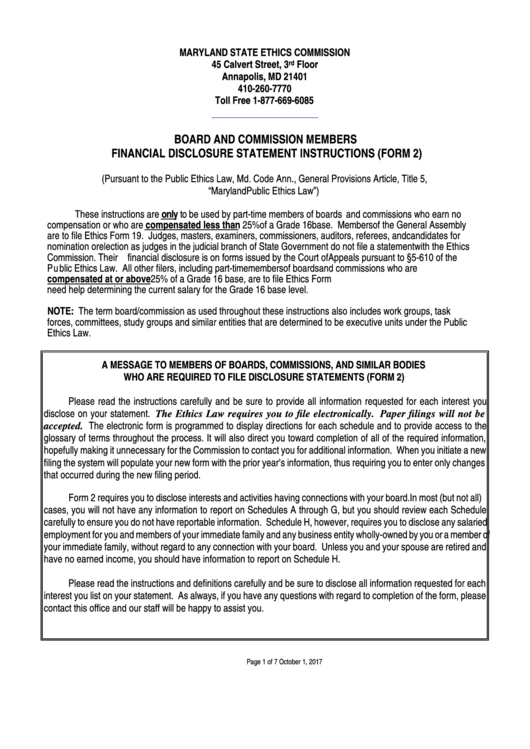

MARYLAND STATE ETHICS COMMISSION

45 Calvert Street, 3

Floor

rd

Annapolis, MD 21401

410-260-7770

Toll Free 1-877-669-6085

BOARD AND COMMISSION MEMBERS

FINANCIAL DISCLOSURE STATEMENT INSTRUCTIONS (FORM 2)

(Pursuant to the Public Ethics Law, Md. Code Ann., General Provisions Article, Title 5,

“Maryland Public Ethics Law”)

These instructions are only to be used by part-time members of boards and commissions who earn no

compensation or who are compensated less than 25% of a Grade 16 base. Members of the General Assembly

are to file Ethics Form 19. Judges, masters, examiners, commissioners, auditors, referees, and candidates for

nomination or election as judges in the judicial branch of State Government do not file a statement with the Ethics

Commission. Their financial disclosure is on forms issued by the Court of Appeals pursuant to §5-610 of the

Public Ethics Law. All other filers, including part-time members of boards and commissions who are

compensated at or above 25% of a Grade 16 base, are to file Ethics Form 1. Please contact this office if you

need help determining the current salary for the Grade 16 base level.

NOTE: The term board/commission as used throughout these instructions also includes work groups, task

forces, committees, study groups and similar entities that are determined to be executive units under the Public

Ethics Law.

A MESSAGE TO MEMBERS OF BOARDS, COMMISSIONS, AND SIMILAR BODIES

WHO ARE REQUIRED TO FILE DISCLOSURE STATEMENTS (FORM 2)

Please read the instructions carefully and be sure to provide all information requested for each interest you

disclose on your statement. The Ethics Law requires you to file electronically. Paper filings will not be

accepted. The electronic form is programmed to display directions for each schedule and to provide access to the

glossary of terms throughout the process. It will also direct you toward completion of all of the required information,

hopefully making it unnecessary for the Commission to contact you for additional information. When you initiate a new

filing the system will populate your new form with the prior year’s information, thus requiring you to enter only changes

that occurred during the new filing period.

Form 2 requires you to disclose interests and activities having connections with your board. In most (but not all)

cases, you will not have any information to report on Schedules A through G, but you should review each Schedule

carefully to ensure you do not have reportable information. Schedule H, however, requires you to disclose any salaried

employment for you and members of your immediate family and any business entity wholly-owned by you or a member of

your immediate family, without regard to any connection with your board. Unless you and your spouse are retired and

have no earned income, you should have information to report on Schedule H.

Please read the instructions and definitions carefully and be sure to disclose all information requested for each

interest you list on your statement. As always, if you have any questions with regard to completion of the form, please

contact this office and our staff will be happy to assist you.

Page 1 of 7

October 1, 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7