Instructions For Schedule E (Form Rev 85 0046) - Jointly Owned Property - Washington Department Of Revenue

ADVERTISEMENT

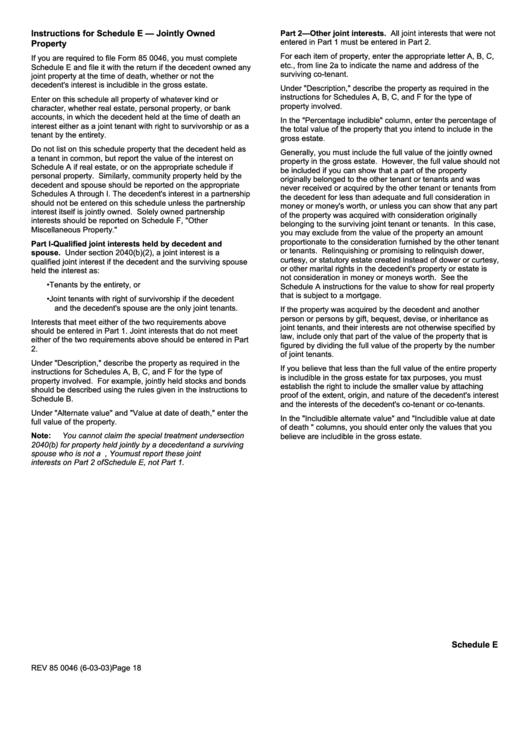

Instructions for Schedule E — Jointly Owned

Part 2—Other joint interests. All joint interests that were not

entered in Part 1 must be entered in Part 2.

Property

For each item of property, enter the appropriate letter A, B, C,

If you are required to file Form 85 0046, you must complete

etc., from line 2a to indicate the name and address of the

Schedule E and file it with the return if the decedent owned any

surviving co-tenant.

joint property at the time of death, whether or not the

decedent's interest is includible in the gross estate.

Under "Description," describe the property as required in the

instructions for Schedules A, B, C, and F for the type of

Enter on this schedule all property of whatever kind or

property involved.

character, whether real estate, personal property, or bank

accounts, in which the decedent held at the time of death an

In the "Percentage includible" column, enter the percentage of

interest either as a joint tenant with right to survivorship or as a

the total value of the property that you intend to include in the

tenant by the entirety.

gross estate.

Do not list on this schedule property that the decedent held as

Generally, you must include the full value of the jointly owned

a tenant in common, but report the value of the interest on

property in the gross estate. However, the full value should not

Schedule A if real estate, or on the appropriate schedule if

be included if you can show that a part of the property

personal property. Similarly, community property held by the

originally belonged to the other tenant or tenants and was

decedent and spouse should be reported on the appropriate

never received or acquired by the other tenant or tenants from

Schedules A through I. The decedent's interest in a partnership

the decedent for less than adequate and full consideration in

should not be entered on this schedule unless the partnership

money or money's worth, or unless you can show that any part

interest itself is jointly owned. Solely owned partnership

of the property was acquired with consideration originally

interests should be reported on Schedule F, "Other

belonging to the surviving joint tenant or tenants. In this case,

Miscellaneous Property."

you may exclude from the value of the property an amount

proportionate to the consideration furnished by the other tenant

Part l-Qualified joint interests held by decedent and

or tenants. Relinquishing or promising to relinquish dower,

spouse. Under section 2040(b)(2), a joint interest is a

curtesy, or statutory estate created instead of dower or curtesy,

qualified joint interest if the decedent and the surviving spouse

or other marital rights in the decedent's property or estate is

held the interest as:

not consideration in money or moneys worth. See the

• Tenants by the entirety, or

Schedule A instructions for the value to show for real property

that is subject to a mortgage.

• Joint tenants with right of survivorship if the decedent

and the decedent's spouse are the only joint tenants.

If the property was acquired by the decedent and another

person or persons by gift, bequest, devise, or inheritance as

Interests that meet either of the two requirements above

joint tenants, and their interests are not otherwise specified by

should be entered in Part 1. Joint interests that do not meet

law, include only that part of the value of the property that is

either of the two requirements above should be entered in Part

figured by dividing the full value of the property by the number

2.

of joint tenants.

Under "Description," describe the property as required in the

If you believe that less than the full value of the entire property

instructions for Schedules A, B, C, and F for the type of

is includible in the gross estate for tax purposes, you must

property involved. For example, jointly held stocks and bonds

establish the right to include the smaller value by attaching

should be described using the rules given in the instructions to

proof of the extent, origin, and nature of the decedent's interest

Schedule B.

and the interests of the decedent's co-tenant or co-tenants.

Under "Alternate value" and "Value at date of death," enter the

In the "Includible alternate value" and "Includible value at date

full value of the property.

of death " columns, you should enter only the values that you

Note:

You cannot claim the special treatment under section

believe are includible in the gross estate.

2040(b) for property held jointly by a decedent and a surviving

spouse who is not a U.S. citizen, You must report these joint

interests on Part 2 of Schedule E, not Part 1.

Schedule E

REV 85 0046 (6-03-03)

Page 18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1