Form Bc-1065 - Battle Creek Income Tax Partnership Return - 2006 Page 3

ADVERTISEMENT

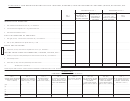

SCHEDULE B - NON-BUSINESS INCOME OR LOSS - INTEREST, DIVIDENDS, SALE OR EXCHANGE OF PROPERTY, RENTS, ROYALTIES, ETC.

DISTRIBUTION OF COL. 1

DISTRIBUTION OF COL. 3

COL. 3

COL. 4

COL. 2

PORTION OF COL. 1

EXCLUDABLE PORTION

COL. 1

COL. 1

PORTION OF COL. 1

APPLICABLE TO

OF COL.3 - NOT

TOTAL

TOTAL

APPLICABLE TO

NONRESIDENT

TAXABLE TO NONRESI-

RESIDENT PARTNERS

PARTNERS

DENT PARTNERS

INTEREST AND DIVIDENDS:

1.

Total interest and dividends from line 25, p. 2. Schedule C .................................................................

$ ...................................

2.

Less: Interest from obligations of U. S. governmental units .................................................................

.....................................

3.

Net interest and dividend income ...........................................................................................................

.....................................

..................................

....................................

SALE OR EXCHANGE OF PROPERTY:

4.

Total gain (or loss) - total of lines 27, 28, 29 and 30, p. 2, Schedule C ...............................................

5.

Gain (or loss) attributable to the period after July 1, 1967 ...................................................................

.....................................

..................................

....................................

$ ...................................

RENTS AND ROYALTIES:

6.

Net income (or loss) from rents and royalties from line 31, p. 2, Schedule C ....................................

.....................................

..................................

....................................

.....................................

INCOME FROM OTHER PARTNERSHIPS, ESTATES, TRUSTS, ETC.:

7.

Income (or loss) from other partnerships and other income from line 26, p. 2, Schedule C .............

....................................

8.

Less exempt income ................................................................................................................................

....................................

9.

Net income (or loss) from other partnerships and other income .........................................................

10.

TOTALS (lines 3, 5, 6 and 9) .............................................................................................

NOTE: Only the totals of Column 2 and 5 should be distributed in Schedule E below, in Cols. 6a and 6b.

SCHEDULE E

SUMMARY OF SCHEDULES B AND C

COL. 1

COL. 2

COL. 3

COL. 4

COL. 5

COL. 6(a)

COL. 6(b)

COL. 7

INCOME FROM BUSINESS

PAYMENT TO PARTNERS-

INCOME SUBJECT

ALLOCATION % FROM P . 4,

ALLOCATED INCOME

NON BUSINESS INCOME

NON BUSINESS INCOME

TOTAL INCOME (ADD COLS.

OPERATIONS (FROM P .2,

SALARIES AND INTEREST

TO ALLOCATION

SCH. D, APPLY ONLY TO

(COL. 3 x % IN COL. 4)

TAXABLE TO RESIDENT

TAXABLE TO NONRESI-

5, 6a AND 6b FOR EACH

SCH. C, LINE 24)

(FROM P . 2, SCH. C, LINE

(ADD COLS. 1 AND 2)

NONRESIDENTS (ENTER

PARTNERS

DENT PARTNERS

PARTNER - ENTER HERE

14)

100% FOR RESIDENTS)

(TOTAL MUST EQUAL

(TOTAL MUST EQUAL

AND ON P . 1, COL. 1)

LINE 10, COL. 2, SCH. B)

LINE 10, COL. 5, SCH. B)

(a) $ ....................................... $ ......................................... $ ........................................

$ ........................................

$ .........................................

$ ......................................... $ .........................................

$ ..........................................

(b) ..........................................

...........................................

...........................................

..........................................

...........................................

...........................................

...........................................

............................................

(c) ...........................................

...........................................

...........................................

..........................................

...........................................

...........................................

...........................................

............................................

(d) ..........................................

...........................................

...........................................

..........................................

...........................................

...........................................

...........................................

............................................

(e) ..........................................

...........................................

...........................................

..........................................

...........................................

...........................................

...........................................

............................................

Totals

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4