Form Ia Fran Es - Iowa Tax Payments For Financial Institutions - 2009

ADVERTISEMENT

Iowa Department of Revenue

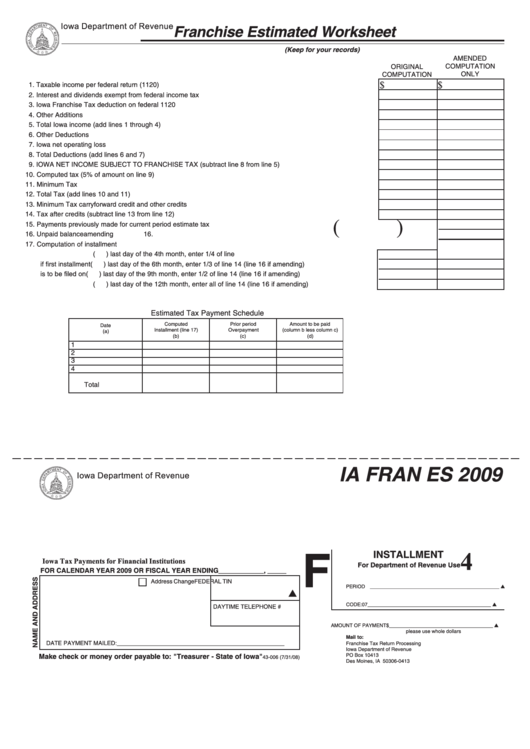

Franchise Estimated Worksheet

(Keep for your records)

AMENDED

COMPUTATION

ORIGINAL

ONLY

COMPUTATION

$

$

1. Taxable income per federal return (1120) ................................................................................................................. 1.

2. Interest and dividends exempt from federal income tax ........................................................................................... 2.

3. Iowa Franchise Tax deduction on federal 1120 ........................................................................................................ 3.

4. Other Additions .......................................................................................................................................................... 4.

5. Total Iowa income (add lines 1 through 4) ................................................................................................................ 5.

6. Other Deductions ....................................................................................................................................................... 6.

7. Iowa net operating loss .............................................................................................................................................. 7.

8. Total Deductions (add lines 6 and 7) ........................................................................................................................ 8.

9. IOWA NET INCOME SUBJECT TO FRANCHISE TAX (subtract line 8 from line 5) ............................................... 9.

10. Computed tax (5% of amount on line 9) ................................................................................................................... 10.

11. Minimum Tax ............................................................................................................................................................. 11.

12. Total Tax (add lines 10 and 11) ................................................................................................................................ 12.

13. Minimum Tax carryforward credit and other credits .................................................................................................. 13.

14. Tax after credits (subtract line 13 from line 12) ........................................................................................................ 14.

(

)

15. Payments previously made for current period estimate tax ..................................................................... Use these two lines

15.

16. Unpaid balance .........................................................................................................................................

only if amending

16.

17. Computation of installment ........................................................................................................................................ 17.

(

) last day of the 4th month, enter 1/4 of line 14 ...............................................................

if first installment (

) last day of the 6th month, enter 1/3 of line 14 (line 16 if amending) .............................

is to be filed on

(

) last day of the 9th month, enter 1/2 of line 14 (line 16 if amending) .............................

(

) last day of the 12th month, enter all of line 14 (line 16 if amending) ............................

Estimated Tax Payment Schedule

Computed

Prior period

Amount to be paid

Date

Installment (line 17)

Overpayment

(column b less column c)

(a)

(b)

(c)

(d)

1

2

3

4

Total

IA FRAN ES 2009

Iowa Department of Revenue

F

4

INSTALLMENT

Iowa Tax Payments for Financial Institutions

For Department of Revenue Use

FOR CALENDAR YEAR 2009 OR FISCAL YEAR ENDING ____________ , _____

Address Change

FEDERAL TIN

PERIOD ______________________________________________

CODE:

07 ____________________________________________

DAYTIME TELEPHONE #

AMOUNT OF PAYMENT $ _____________________________________

please use whole dollars

Mail to:

DATE PAYMENT MAILED: ___________________________________________________

Franchise Tax Return Processing

Iowa Department of Revenue

Make check or money order payable to: "Treasurer - State of Iowa"

PO Box 10413

43-006 (7/31/08)

Des Moines, IA 50306-0413

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2