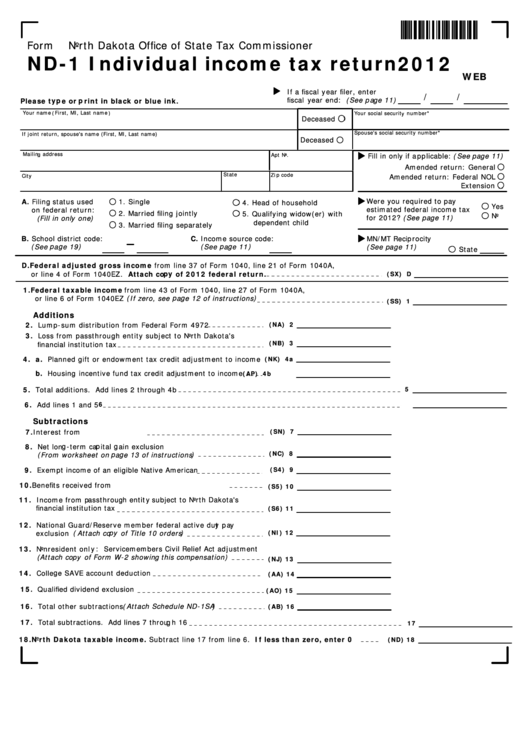

Form

North Dakota Office of State Tax Commissioner

ND-1 Individual income tax return

2012

WEB

If a fiscal year filer, enter

/

/

fiscal year end: (See page 11)

Please type or print in black or blue ink.

Your name (First, MI, Last name)

Your social security number*

Deceased

Spouse's social security number*

If joint return, spouse's name (First, MI, Last name)

Deceased

Mailing address

Apt No.

Fill in only if applicable: (See page 11)

Amended return: General

State

Zip code

City

Amended return: Federal NOL

Extension

Were you required to pay

A. Filing status used

1. Single

4. Head of household

Yes

estimated federal income tax

on federal return:

2. Married filing jointly

5. Qualifying widow(er) with

No

for 2012? (See page 11)

(Fill in only one)

dependent child

3. Married filing separately

C. Income source code:

B. School district code:

MN/MT Reciprocity

(See page 19)

(See page 11)

(See page 11)

State

D. Federal adjusted gross income from line 37 of Form 1040, line 21 of Form 1040A,

or line 4 of Form 1040EZ. Attach copy of 2012 federal return.

(SX) D

1. Federal taxable income from line 43 of Form 1040, line 27 of Form 1040A,

or line 6 of Form 1040EZ (If zero, see page 12 of instructions)

(SS) 1

Additions

2. Lump-sum distribution from Federal Form 4972

(NA) 2

3. Loss from passthrough entity subject to North Dakota's

(NB) 3

financial institution tax

4. a. Planned gift or endowment tax credit adjustment to income

(NK) 4a

b. Housing incentive fund tax credit adjustment to income

(AP) 4b

5. Total additions. Add lines 2 through 4b

5

6. Add lines 1 and 5

6

Subtractions

7. Interest from U.S. obligations

(SN) 7

8. Net long-term capital gain exclusion

(NC) 8

(From worksheet on page 13 of instructions)

9. Exempt income of an eligible Native American

(S4) 9

10. Benefits received from U.S. Railroad Retirement Board

(S5) 10

11. Income from passthrough entity subject to North Dakota's

financial institution tax

(S6) 11

12. National Guard/Reserve member federal active duty pay

(NI) 12

exclusion (Attach copy of Title 10 orders)

13. Nonresident only: Servicemembers Civil Relief Act adjustment

(Attach copy of Form W-2 showing this compensation)

(NJ) 13

14. College SAVE account deduction

(AA) 14

15. Qualified dividend exclusion

(AO) 15

16. Total other subtractions (Attach Schedule ND-1SA)

(AB) 16

17. Total subtractions. Add lines 7 through 16

17

18. North Dakota taxable income. Subtract line 17 from line 6. If less than zero, enter 0

(ND) 18

1

1 2

2