Form Pwr - Prepaid Wireless Charge Return - 2015 Page 2

ADVERTISEMENT

PREPAID WIRELESS 911 CHARGE

General Instructions

AMENDED RETURNS:

If adjustments need to be made after a return has already been received by the

WHO MUST FILE A RETURN:

Department, an amended return must be submitted on an Prepaid Wireless 911

All dealers who sell prepaid wireless telecommunications services must

Charge form with the amended return box checked. The amended return

collect a charge of $0.75 per transaction. The charge must be collected at

should reflect the changes to the original return information.

the time of retail sale and be separately stated on the dealer’s invoice,

receipt, or similar document provided to the consumer.

WHEN YOU MUST FILE:

RECORDS:

The Prepaid Wireless return must be filed on the same frequency as the

A copy of this return and records of both purchases and sales including sales

Master Sales and Use Tax account of the taxpayer. If no Master is being

invoices must be retained and open for inspection by authorized representa-

used, then this must match the frequency of the most frequent of the filing

tives of the Georgia Department of Revenue.

frequencies used by the taxpayer’s Sales and Use tax accounts. The return

and payment are due on the same day as the Georgia Sales and Use tax

Line-by-Line Instructions

return.

HOW TO FILE:

Record the Prepaid Charge Number, name, and address of the registered taxpayer.

Taxpayers mandated to electronically file and pay for Sales and Use tax

The Period Ending should be the end date (mm/dd/yy) of the reporting period.

are also mandated to electronically file and pay the Prepaid Wireless 911

Check the Amended Return box if you are amending a previously filed return.

Charge return . All taxpayers are encouraged to file and pay

electronically. Please visit

Line 1: Enter the Total Number of Prepaid Wireless Transactions in which

the

charge is applicable. A seller may elect to not apply the charge to sales of

PENALTY AND INTEREST ON DELINQUENT RETURNS:

prepaid wireless service of 10 minutes or less or $5.00 or less when the sales

- Returns and payments are considered timely if postmarked by the due

price is itemized on the customer's invoice and the single retail transaction

date of the return (generally the 20th of the month) following the close of

does not contain a prepaid wireless device or another prepaid wireless service.

the reporting period. Taxpayers will be billed penalty and interest for all

Line 2: The rate is $0.75 per prepaid wireless transaction.

returns and payments filed after this date.

- A penalty of five percent (.05) of the amount due or five dollars ($5.00),

Line 3:

E

t n

r e

h t

e

B

a

a l

n

c

e

D

u

. e

M

u

t l

p i

y l

L

n i

e

1

b

y

L

n i

e

. 2

E

t n

r e

h t

e

whichever is greater, will be billed after the return is processed. This

penalty will be billed for each month, or fraction of a month, when the return

unrounded figure.

is delinquent.

Line 4: If the return is filed and paid on or before the due date, Line 3 x 0.03.

- The penalty amount will not exceed twenty-five percent (.25) or twenty

five dollars ($25.00), whichever is greater.

Line 5: Subtract Line 4 from Line 3 and enter the Amount Due. Enter the

- Interest is calculated at one percent (.01) of the amount delinquent for

unrounded figure. This is the amount you must remit.

each month, or fraction of a month, and will continue as long as the amount

is delinquent.

Mailing Instructions

IF YOU ARE DUE A REFUND:

Mail the return to the following address:

Use Georgia Form ST-12 to claim any refund amount due to overpayment.

Return or amended return with check/money order remittance

CERTIFICATION AND SIGNATURE:

Georgia Department of Revenue

The return must be completed and signed in order to be considered timely

P O Box 105296

filed.

Atlanta, Georgia 30348-5296

Additional forms and information may be obtained from the Department of

Revenue website:

PLEASE DO NOT mail this entire page. Please cut along dotted line and mail only coupon and payment.

PLEASE DO NOT STAPLE. PLEASE REMOVE ALL CHECK STUBS.

Cut on dotted line

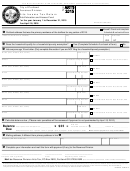

BUSINESS NAME AND ADDRESS

PWR

(Rev. 11/05/15)

Prepaid Wireless Charge Return

Amended Return

Prepaid Charge Number

Period Ending

Vendor Code

Total Number of Prepaid

911-

040

1

Wireless Transactions

Under penalties of perjury, I certify that this return, including any accompanying schedules or statements, has

2

x 0.75

been examined by me and is to the best of my knowledge and belief a true and complete return.

Rate

T

a

x

p

a

y

r e

S

g i

n

a

u t

e r

D

a

e t

Balance Due

3

(Line 1 x Line 2)

Taxpayer Name

Telephone Number

Vendor’s Compensation

(See Instructions)

4

Line 3 x 0.03

Preparer Signature (If other than taxpayer)

Date

Total Amount Due

5

(Line 3 minus Line 4)

2620911920000000000000004000000000002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2