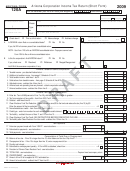

Form 120a Draft - Arizona Corporation Income Tax Return (Short Form) - 2009 Page 2

ADVERTISEMENT

Name:

EIN:

AZ Form 120A (2009)

Page 2 of 2

Schedule A - Additions to Taxable Income

A1 Total federal depreciation ..............................................................................................................................................................

A1

00

A2 IRC § 179 expense in excess of allowable amount ......................................................................................................................

A2

00

A3 Taxes based on income paid to any state (INCLUDING ARIZONA), local governments or foreign governments........................

A3

00

A4 Interest on obligations of other states, foreign countries, or political subdivisions .......................................................................

A4

00

A5 Special deductions claimed on federal return ...............................................................................................................................

A5

00

A6 Federal net operating loss deduction claimed on federal return ...................................................................................................

A6

00

A7 Commissions and other expenses paid or accrued to a Domestic International Sales Corporation (DISC) ................................

A7

00

A8 Capital investment by certifi ed defense contractor - attach schedule ...........................................................................................

A8

00

A9 Additions related to Arizona tax credits - attach schedule ............................................................................................................

A9

00

A10 Other additions to federal taxable income - attach schedule ........................................................................................................

A10

00

A11 Total - add lines A1 through A10. Enter total here and on page 1, line 2 ......................................................................................

A11

00

Schedule B - Subtractions From Taxable Income

B1 Recalculated Arizona depreciation - see instructions ...................................................................................................................

B1

00

B2 Basis adjustment for property sold or otherwise disposed of during the taxable year - see instructions ......................................

B2

00

B3 Adjustment for IRC § 179 expense not allowed ............................................................................................................................

B3

00

B4 Dividends received from 50% or more controlled domestic corporations .....................................................................................

B4

00

B5 Foreign dividend gross-up ............................................................................................................................................................

B5

00

B6 Dividends received from foreign corporations ..............................................................................................................................

B6

00

B7 Dividends received from a DISC ...................................................................................................................................................

B7

00

B8 Interest on U.S. obligations ...........................................................................................................................................................

B8

00

B9 Agricultural crops charitable contribution ......................................................................................................................................

B9

00

B10 Capital investment by certifi ed defense contractor - attach schedule ...........................................................................................

B10

00

B11 Other subtractions from federal taxable income - attach schedule ...............................................................................................

B11

00

B12 Total - add lines B1 through B11. Enter total here and on page 1, line 4 ......................................................................................

B12

00

Schedule C - Additional Information

C1 Date business began in Arizona ______/______/______

MM

MM

DD

DD

YYYY

YYYY

C2 Address at which tax records are located for audit purposes:

C3 The taxpayer designates the individual listed below as the person to contact to schedule an audit of this return and authorizes

the disclosure of confi dential information to this individual. (See instructions, page 10.)

(

)

Name and title

Phone number

C4 List prior taxable years for which a federal examination has been fi nalized

NOTE: ARS § 43-327 requires the taxpayer, within ninety days after fi nal determination, to report these changes under separate

cover to the Arizona Department of Revenue or to fi le amended returns reporting these changes. (See instructions, page 3.)

C5 Amount of Arizona taxable income for prior taxable year (2008 Form 120A, line 7.)

C6 Indicate tax accounting method:

Cash

Accrual

Other

(Specify method.)

Certifi cation

The following certifi cation must be signed by one or more of the following offi cers (president, treasurer, or any other principal offi cer).

Under penalties of perjury, I (we), the undersigned offi cer(s) authorized to sign this return, declare that I (we) have examined this return, including the

accompanying schedules and statements, and to the best of my (our) knowledge and belief, it is a true, correct and complete return, made in good faith,

for the taxable year stated pursuant to the income tax laws of the State of Arizona.

Please

Offi cer’s signature

Title

Date

Sign

Here

Offi cer’s signature

Title

Date

Paid

(

)

Preparer’s

Preparer’s signature

Date

Business telephone number

Use Only

Firm’s name (or preparer’s, if self-employed)

Preparer’s TIN

DRAFT 09-09-09

DRAFT 09-09-09

Firm’s address

Zip code

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

ADOR 91-0023 (09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2