Ohio Form It 3 - Transmittal Of Wage And Tax Statements

ADVERTISEMENT

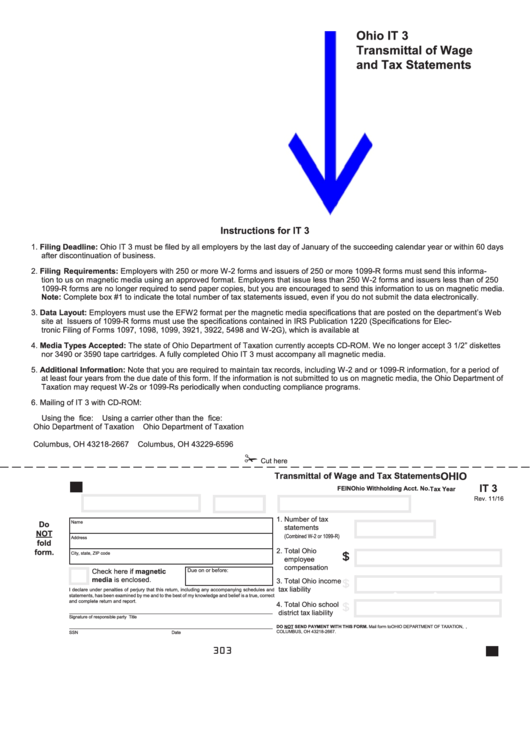

Ohio IT 3

Transmittal of Wage

and Tax Statements

Instructions for IT 3

1. Filing Deadline: Ohio IT 3 must be filed by all employers by the last day of January of the succeeding calendar year or within 60 days

after discontinuation of business.

2. Filing Requirements: Employers with 250 or more W-2 forms and issuers of 250 or more 1099-R forms must send this informa-

tion to us on magnetic media using an approved format. Employers that issue less than 250 W-2 forms and issuers less than of 250

1099-R forms are no longer required to send paper copies, but you are encouraged to send this information to us on magnetic media.

Note: Complete box #1 to indicate the total number of tax statements issued, even if you do not submit the data electronically.

3. Data Layout: Employers must use the EFW2 format per the magnetic media specifications that are posted on the department’s Web

site at tax.ohio.gov. Issuers of 1099-R forms must use the specifications contained in IRS Publication 1220 (Specifications for Elec-

tronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498 and W-2G), which is available at

4. Media Types Accepted: The state of Ohio Department of Taxation currently accepts CD-ROM. We no longer accept 3 1/2” diskettes

nor 3490 or 3590 tape cartridges. A fully completed Ohio IT 3 must accompany all magnetic media.

5. Additional Information: Note that you are required to maintain tax records, including W-2 and or 1099-R information, for a period of

at least four years from the due date of this form. If the information is not submitted to us on magnetic media, the Ohio Department of

Taxation may request W-2s or 1099-Rs periodically when conducting compliance programs.

6. Mailing of IT 3 with CD-ROM:

Using the U.S. Post Office:

Using a carrier other than the U.S. Post Office:

Ohio Department of Taxation

Ohio Department of Taxation

P.O. Box 182667

4485 Northland Ridge Blvd.

Columbus, OH 43218-2667

Columbus, OH 43229-6596

✁

Cut here

OHIO

Transmittal of Wage and Tax Statements

IT 3

Ohio Withholding Acct. No.

FEIN

Tax Year

Rev. 11/16

1. Number of tax

Do

Name

statements

NOT

(Combined W-2 or 1099-R)

Address

fold

2. Total Ohio

form.

City, state, ZIP code

$

employee

compensation

Check here if magnetic

Due on or before:

,

,

,

,

media is enclosed.

3. Total Ohio income

$

tax liability

I declare under penalties of perjury that this return, including any accompanying schedules and

statements, has been examined by me and to the best of my knowledge and belief is a true, correct

and complete return and report.

4. Total Ohio school

$

district tax liability

Signature of responsible party

Title

DO NOT SEND PAYMENT WITH THIS FORM. Mail form to OHIO DEPARTMENT OF TAXATION, P.O. BOX 182667,

COLUMBUS, OH 43218-2667.

SSN

Date

303

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1