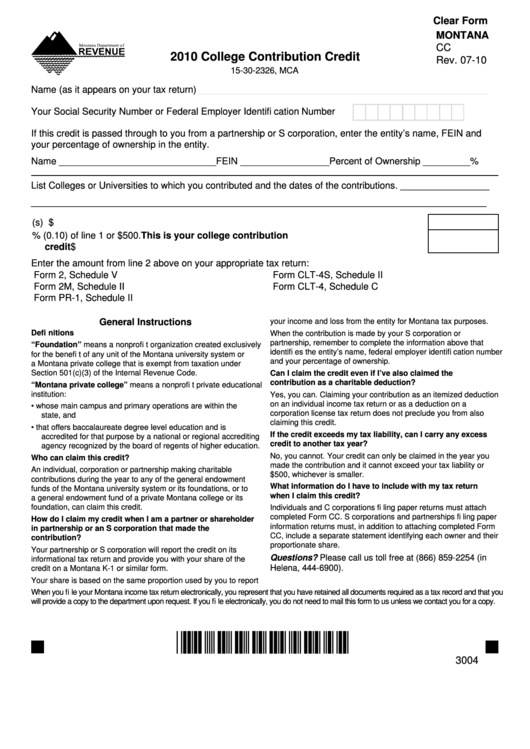

Clear Form

MONTANA

CC

2010 College Contribution Credit

Rev. 07-10

15-30-2326, MCA

Name (as it appears on your tax return)

_______________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and

your percentage of ownership in the entity.

Name ______________________________FEIN _________________ Percent of Ownership _________ %

List Colleges or Universities to which you contributed and the dates of the contributions. _________________

_______________________________________________________________________________________

1. Enter total amount of contribution(s) ...................................................................................$

2. Enter here the lesser of 10% (0.10) of line 1 or $500. This is your college contribution

credit ...................................................................................................................................$

Enter the amount from line 2 above on your appropriate tax return:

Form 2, Schedule V

Form CLT-4S, Schedule II

Form 2M, Schedule II

Form CLT-4, Schedule C

Form PR-1, Schedule II

General Instructions

your income and loss from the entity for Montana tax purposes.

Defi nitions

When the contribution is made by your S corporation or

partnership, remember to complete the information above that

“Foundation” means a nonprofi t organization created exclusively

identifi es the entity’s name, federal employer identifi cation number

for the benefi t of any unit of the Montana university system or

and your percentage of ownership.

a Montana private college that is exempt from taxation under

Section 501(c)(3) of the Internal Revenue Code.

Can I claim the credit even if I’ve also claimed the

contribution as a charitable deduction?

“Montana private college” means a nonprofi t private educational

institution:

Yes, you can. Claiming your contribution as an itemized deduction

on an individual income tax return or as a deduction on a

• whose main campus and primary operations are within the

corporation license tax return does not preclude you from also

state, and

claiming this credit.

• that offers baccalaureate degree level education and is

If the credit exceeds my tax liability, can I carry any excess

accredited for that purpose by a national or regional accrediting

credit to another tax year?

agency recognized by the board of regents of higher education.

No, you cannot. Your credit can only be claimed in the year you

Who can claim this credit?

made the contribution and it cannot exceed your tax liability or

An individual, corporation or partnership making charitable

$500, whichever is smaller.

contributions during the year to any of the general endowment

What information do I have to include with my tax return

funds of the Montana university system or its foundations, or to

when I claim this credit?

a general endowment fund of a private Montana college or its

foundation, can claim this credit.

Individuals and C corporations fi ling paper returns must attach

completed Form CC. S corporations and partnerships fi ling paper

How do I claim my credit when I am a partner or shareholder

information returns must, in addition to attaching completed Form

in partnership or an S corporation that made the

CC, include a separate statement identifying each owner and their

contribution?

proportionate share.

Your partnership or S corporation will report the credit on its

Questions? Please call us toll free at (866) 859-2254 (in

informational tax return and provide you with your share of the

Helena, 444-6900).

credit on a Montana K-1 or similar form.

Your share is based on the same proportion used by you to report

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*30040101*

3004

1

1