Form 801 - Assessor Notification

Download a blank fillable Form 801 - Assessor Notification in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 801 - Assessor Notification with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

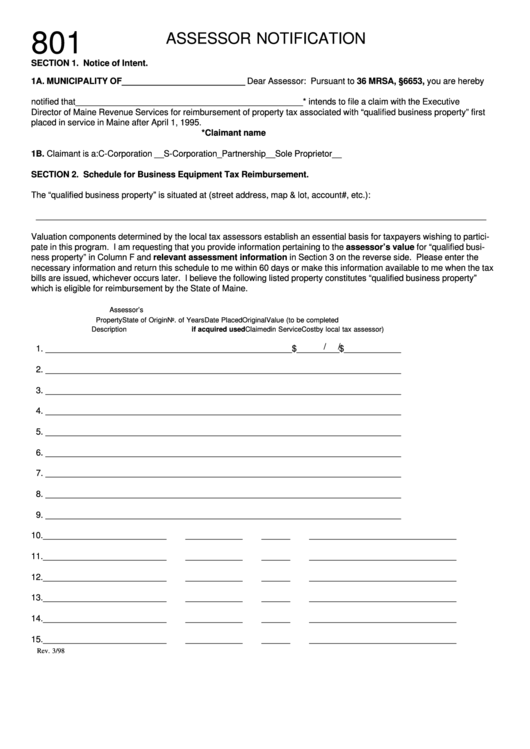

801

ASSESSOR NOTIFICATION

SECTION 1. Notice of Intent.

1A. MUNICIPALITY OF __________________________ Dear Assessor: Pursuant to 36 MRSA, §6653, you are hereby

notified that ________________________________________________ * intends to file a claim with the Executive

Director of Maine Revenue Services for reimbursement of property tax associated with “qualified business property” first

placed in service in Maine after April 1, 1995.

*Claimant name

1B. Claimant is a:

C-Corporation __

S-Corporation _

Partnership __

Sole Proprietor __

SECTION 2. Schedule for Business Equipment Tax Reimbursement.

The “qualified business property” is situated at (street address, map & lot, account#, etc.):

_______________________________________________________________________________________________

Valuation components determined by the local tax assessors establish an essential basis for taxpayers wishing to partici-

pate in this program. I am requesting that you provide information pertaining to the assessor’s value for “qualified busi-

ness property” in Column F and relevant assessment information in Section 3 on the reverse side. Please enter the

necessary information and return this schedule to me within 60 days or make this information available to me when the tax

bills are issued, whichever occurs later. I believe the following listed property constitutes “qualified business property”

which is eligible for reimbursement by the State of Maine.

A.

B.

C.

D.

E.

F.

Assessor’s

Property

State of Origin

No. of Years

Date Placed

Original

Value (to be completed

Description

if acquired used

Claimed

in Service

Cost

by local tax assessor)

/

/

1. __________________________

____________

______

________

$ _________ $ ____________

2. __________________________

____________

______

________

__________

_____________

3. __________________________

____________

______

________

__________

_____________

4. __________________________

____________

______

________

__________

_____________

5. __________________________

____________

______

________

__________

_____________

6. __________________________

____________

______

________

__________

_____________

7. __________________________

____________

______

________

__________

_____________

8. __________________________

____________

______

________

__________

_____________

9. __________________________

____________

______

________

__________

_____________

10. __________________________

____________

______

________

__________

_____________

11. __________________________

____________

______

________

__________

_____________

12. __________________________

____________

______

________

__________

_____________

13. __________________________

____________

______

________

__________

_____________

14. __________________________

____________

______

________

__________

_____________

15. __________________________

____________

______

________

__________

_____________

Rev. 3/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2