Form Pgh-40 - Individual Earned Income/form Wtex - Non-Resident Exemption Certificate - 2004

ADVERTISEMENT

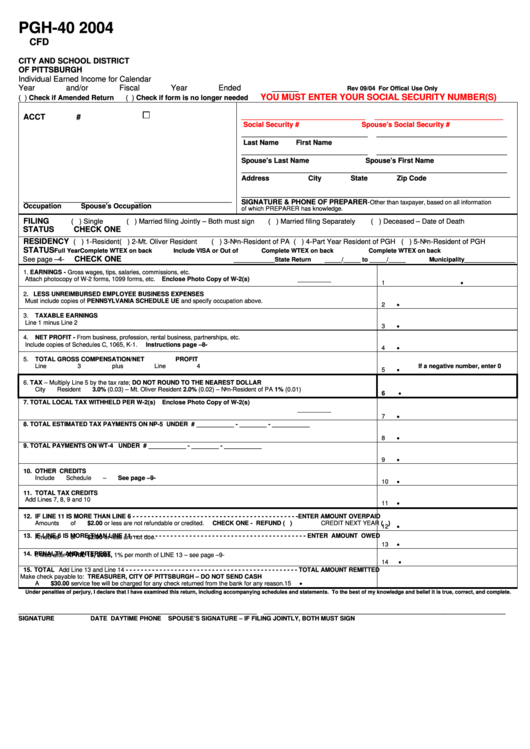

PGH-40 2004

CFD

CITY AND SCHOOL DISTRICT

OF PITTSBURGH

Individual Earned Income for Calendar

Year and/or Fiscal Year Ended ______

Rev 09/04 For Offical Use Only

YOU MUST ENTER YOUR SOCIAL SECURITY NUMBER(S)

( ) Check if Amended Return

( ) Check if form is no longer needed

__________________________

___________________________

ACCT #

Social Security #

Spouse’s Social Security #

_____________________________ ______________________________

Last Name

First Name

_____________________________ ______________________________

Spouse’s Last Name

Spouse’s First Name

_____________________________________________________________

Address

City

State

Zip Code

_____________________________________________________________________

______________________

_________________________

SIGNATURE & PHONE OF PREPARER-

Other than taxpayer, based on all information

Occupation

Spouse’s Occupation

of which PREPARER has knowledge.

FILING

( ) Single

( ) Married filing Jointly – Both must sign

( ) Married filing Separately

( ) Deceased – Date of Death

STATUS

CHECK ONE

RESIDENCY

( ) 1-Resident

( ) 2-Mt. Oliver Resident

( ) 3-Non-Resident of PA

( ) 4-Part Year Resident of PGH ( ) 5-Non-Resident of PGH

STATUS

Full Year

Complete WTEX on back

Include VISA or Out of

Complete WTEX on back

Complete WTEX on back

CHECK ONE

See page –4-

____________State Return

_____/_____ to _____/_____

Municipality_______________

1.

EARNINGS - Gross wages, tips, salaries, commissions, etc.

Attach photocopy of W-2 forms, 1099 forms, etc.

Enclose Photo Copy of W-2(s)

•

1

2.

LESS UNREIMBURSED EMPLOYEE BUSINESS EXPENSES

Must include copies of PENNSYLVANIA SCHEDULE UE and specify occupation above.

•

2

3.

TAXABLE EARNINGS

Line 1 minus Line 2

•

3

4.

NET PROFIT - From business, profession, rental business, partnerships, etc.

Include copies of Schedules C, 1065, K-1.

Instructions page –8-

•

4

5.

TOTAL GROSS COMPENSATION/NET PROFIT

Line 3 plus Line 4

If a negative number, enter 0

•

5

6.

TAX – Multiply Line 5 by the tax rate; DO NOT ROUND TO THE NEAREST DOLLAR

City Resident 3.0% (0.03) – Mt. Oliver Resident 2.0% (0.02) – Non-Resident of PA 1% (0.01)

•

6

7.

TOTAL LOCAL TAX WITHHELD PER W-2(s)

Enclose Photo Copy of W-2(s)

•

7

8.

TOTAL ESTIMATED TAX PAYMENTS ON NP-5

UNDER S.S.# ___________ - ________ - ___________

•

8

9.

TOTAL PAYMENTS ON WT-4

UNDER S.S.# ___________ - ________ - ___________

•

9

10. OTHER CREDITS

Include Schedule – See page –9-

•

10

11. TOTAL TAX CREDITS

Add Lines 7, 8, 9 and 10

•

11

12. IF LINE 11 IS MORE THAN LINE 6 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -ENTER AMOUNT OVERPAID

Amounts of $2.00 or less are not refundable or credited.

CHECK ONE - REFUND ( )

CREDIT NEXT YEAR ( )

•

12

13. IF LINE 6 IS MORE THAN LINE 11 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - ENTER AMOUNT OWED

Amounts of $2.00 or less are not due.

•

13

14. PENALTY AND INTEREST

•

If filed after APRIL 15, 2005, 1% per month of LINE 13 – see page –9-

14

15. TOTAL Add Line 13 and Line 14 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - TOTAL AMOUNT REMITTED

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

•

A $30.00 service fee will be charged for any check returned from the bank for any reason.

15

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements. To the best of my knowledge and belief it is true, correct, and complete.

______________________________________________________________________

_______________________________________________________________________

SIGNATURE

DATE

DAYTIME PHONE

SPOUSE’S SIGNATURE – IF FILING JOINTLY, BOTH MUST SIGN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2