Clear Form

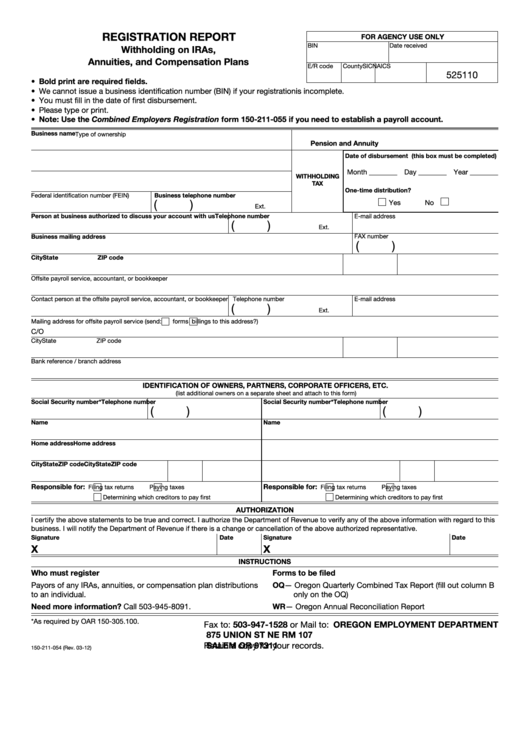

REGISTRATION REPORT

FOR AGENCY USE ONLY

BIN

Date received

Withholding on IRAs,

Annuities, and Compensation Plans

E/R code

County

SIC

NAICS

525110

• Bold print are required fields.

• We cannot issue a business identification number (BIN) if your registrationis incomplete.

• You must fill in the date of first disbursement.

• Please type or print.

• Note: Use the Combined Employers Registration form 150-211-055 if you need to establish a payroll account.

Business name

Type of ownership

Pension and Annuity

Date of disbursement (this box must be completed)

Month ________ Day ________ Year ________

WITHHOLDING

TAX

One-time distribution?

Business telephone number

Federal identification number (FEIN)

( )

Yes

No

Ext.

Person at business authorized to discuss your account with us

Telephone number

E-mail address

( )

Ext.

Business mailing address

FAX number

( )

City

State

ZIP code

Offsite payroll service, accountant, or bookkeeper

Contact person at the offsite payroll service, accountant, or bookkeeper Telephone number

E-mail address

( )

Ext.

Mailing address for offsite payroll service (send:

forms

billings to this address?)

C/O

City

State

ZIP code

Bank reference / branch address

IDENTIFICATION OF OWNERS, PARTNERS, CORPORATE OFFICERS, ETC.

(list additional owners on a separate sheet and attach to this form)

Social Security number*

Telephone number

Social Security number*

Telephone number

( )

( )

Name

Name

Home address

Home address

City

State

ZIP code

City

State

ZIP code

Responsible for:

Responsible for:

Filing tax returns

Paying taxes

Filing tax returns

Paying taxes

Determining which creditors to pay first

Determining which creditors to pay first

AUTHORIZATION

I certify the above statements to be true and correct. I authorize the Department of Revenue to verify any of the above information with regard to this

business. I will notify the Department of Revenue if there is a change or cancellation of the above authorized representative.

Signature

Date

Signature

Date

X

X

INSTRUCTIONS

Who must register

Forms to be filed

OQ— Oregon Quarterly Combined Tax Report (fill out column B

Payors of any IRAs, annuities, or compensation plan distributions

to an individual.

only on the OQ)

Need more information? Call 503-945-8091.

WR— O regon Annual Reconciliation Report

*As required by OAR 150-305.100.

Fax to: 503-947-1528 or Mail to: OREGON EMPLOYMENT DEPARTMENT

875 UNION ST NE RM 107

SALEM OR 97311

Retain a copy for your records.

150-211-054 (Rev. 03-12)

1

1