Form C-7 - Wage List Adjustment Schedule

ADVERTISEMENT

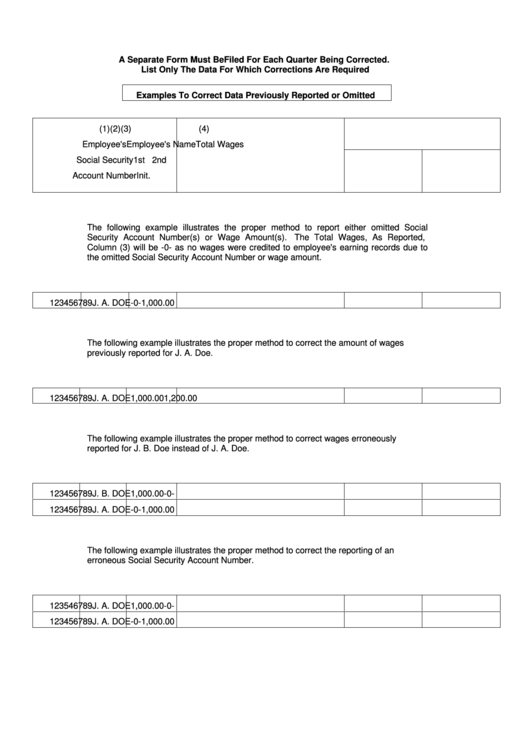

A Separate Form Must Be Filed For Each Quarter Being Corrected.

List Only The Data For Which Corrections Are Required

Examples To Correct Data Previously Reported or Omitted

(1)

(2)

(3)

(4)

Employee's

Employee's Name

Total Wages

Social Security

1st

2nd

Account Number

Init.

Init.

Last

As Reported

Corrected

The following example illustrates the proper method to report either omitted Social

Security Account Number(s) or Wage Amount(s).

The Total Wages, As Reported,

Column (3) will be -0- as no wages were credited to employee's earning records due to

the omitted Social Security Account Number or wage amount.

123

45

6789

J. A. DOE

-0-

1,000.00

The following example illustrates the proper method to correct the amount of wages

previously reported for J. A. Doe.

123

45

6789

J. A. DOE

1,000.00

1,200.00

The following example illustrates the proper method to correct wages erroneously

reported for J. B. Doe instead of J. A. Doe.

123

45

6789

J. B. DOE

1,000.00

-0-

123

45

6789

J. A. DOE

-0-

1,000.00

The following example illustrates the proper method to correct the reporting of an

erroneous Social Security Account Number.

123

54

6789

J. A. DOE

1,000.00

-0-

123

45

6789

J. A. DOE

-0-

1,000.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3