Instructions For Virginia Schedule Vk-1 - Consolidated Owner'S Share Of Income And Virginia Modifications And Credits

ADVERTISEMENT

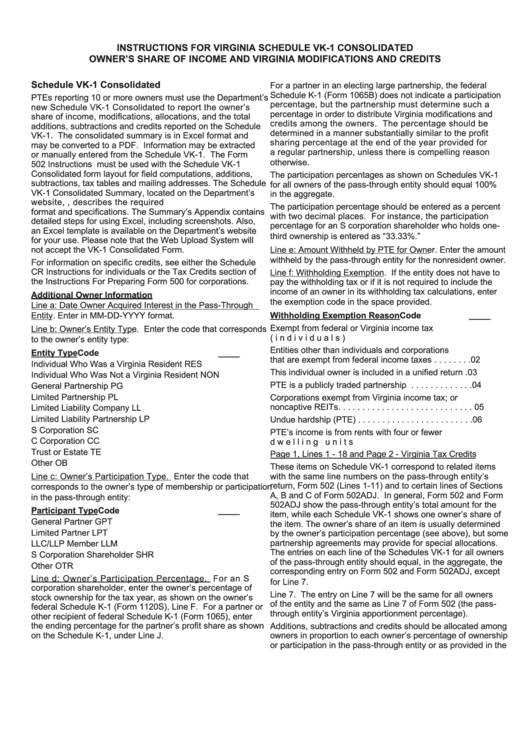

INSTRUCTIONS FOR VIRGINIA SCHEDULE VK-1 CONSOLIDATED

OWNER’S SHARE OF INCOME AND VIRGINIA MODIFICATIONS AND CREDITS

Schedule VK-1 Consolidated

For a partner in an electing large partnership, the federal

Schedule K-1 (Form 1065B) does not indicate a participation

PTEs reporting 10 or more owners must use the Department’s

percentage, but the partnership must determine such a

new Schedule VK-1 Consolidated to report the owner’s

percentage in order to distribute Virginia modifications and

share of income, modifications, allocations, and the total

credits among the owners. The percentage should be

additions, subtractions and credits reported on the Schedule

determined in a manner substantially similar to the profit

VK-1. The consolidated summary is in Excel format and

sharing percentage at the end of the year provided for

may be converted to a PDF. Information may be extracted

a regular partnership, unless there is compelling reason

or manually entered from the Schedule VK-1. The Form

otherwise.

502 Instructions must be used with the Schedule VK-1

Consolidated form layout for field computations, additions,

The participation percentages as shown on Schedules VK-1

subtractions, tax tables and mailing addresses. The Schedule

for all owners of the pass-through entity should equal 100%

VK-1 Consolidated Summary, located on the Department’s

in the aggregate.

website, , describes the required

The participation percentage should be entered as a percent

format and specifications. The Summary’s Appendix contains

with two decimal places. For instance, the participation

detailed steps for using Excel, including screenshots. Also,

percentage for an S corporation shareholder who holds one-

an Excel template is available on the Department’s website

third ownership is entered as “33.33%.”

for your use. Please note that the Web Upload System will

Line e: Amount Withheld by PTE for Owner. Enter the amount

not accept the VK-1 Consolidated Form.

withheld by the pass-through entity for the nonresident owner.

For information on specific credits, see either the Schedule

CR Instructions for individuals or the Tax Credits section of

Line f: Withholding Exemption. If the entity does not have to

the Instructions For Preparing Form 500 for corporations.

pay the withholding tax or if it is not required to include the

income of an owner in its withholding tax calculations, enter

Additional Owner Information

the exemption code in the space provided.

Line a: Date Owner Acquired Interest in the Pass-Through

Entity. Enter in MM-DD-YYYY format.

Withholding Exemption Reason

Code

Exempt from federal or Virginia income tax

Line b: Owner’s Entity Type. Enter the code that corresponds

(individuals) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 01

to the owner’s entity type:

Entities other than individuals and corporations

Entity Type

Code

that are exempt from federal income taxes . . . . . . . . 02

Individual Who Was a Virginia Resident

RES

This individual owner is included in a unified return . 03

Individual Who Was Not a Virginia Resident

NON

PTE is a publicly traded partnership . . . . . . . . . . . . . 04

General Partnership

PG

Limited Partnership

PL

Corporations exempt from Virginia income tax; or

noncaptive REITs. . . . . . . . . . . . . . . . . . . . . . . . . . . . 05

Limited Liability Company

LL

Limited Liability Partnership

LP

Undue hardship (PTE) . . . . . . . . . . . . . . . . . . . . . . . . 06

S Corporation

SC

PTE’s income is from rents with four or fewer

C Corporation

CC

dwelling units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 07

Trust or Estate

TE

Page 1, Lines 1 - 18 and Page 2 - Virginia Tax Credits

Other

OB

These items on Schedule VK-1 correspond to related items

with the same line numbers on the pass-through entity’s

Line c: Owner’s Participation Type. Enter the code that

return, Form 502 (Lines 1-11) and to certain lines of Sections

corresponds to the owner’s type of membership or participation

A, B and C of Form 502ADJ. In general, Form 502 and Form

in the pass-through entity:

502ADJ show the pass-through entity’s total amount for the

Participant Type

Code

item, while each Schedule VK-1 shows one owner’s share of

General Partner

GPT

the item. The owner’s share of an item is usually determined

Limited Partner

LPT

by the owner’s participation percentage (see above), but some

partnership agreements may provide for special allocations.

LLC/LLP Member

LLM

The entries on each line of the Schedules VK-1 for all owners

S Corporation Shareholder

SHR

of the pass-through entity should equal, in the aggregate, the

Other

OTR

corresponding entry on Form 502 and Form 502ADJ, except

Line d: Owner’s Participation Percentage. For an S

for Line 7.

corporation shareholder, enter the owner’s percentage of

Line 7. The entry on Line 7 will be the same for all owners

stock ownership for the tax year, as shown on the owner’s

of the entity and the same as Line 7 of Form 502 (the pass-

federal Schedule K-1 (Form 1120S), Line F. For a partner or

through entity’s Virginia apportionment percentage).

other recipient of federal Schedule K-1 (Form 1065), enter

the ending percentage for the partner’s profit share as shown

Additions, subtractions and credits should be allocated among

on the Schedule K-1, under Line J.

owners in proportion to each owner’s percentage of ownership

or participation in the pass-through entity or as provided in the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2