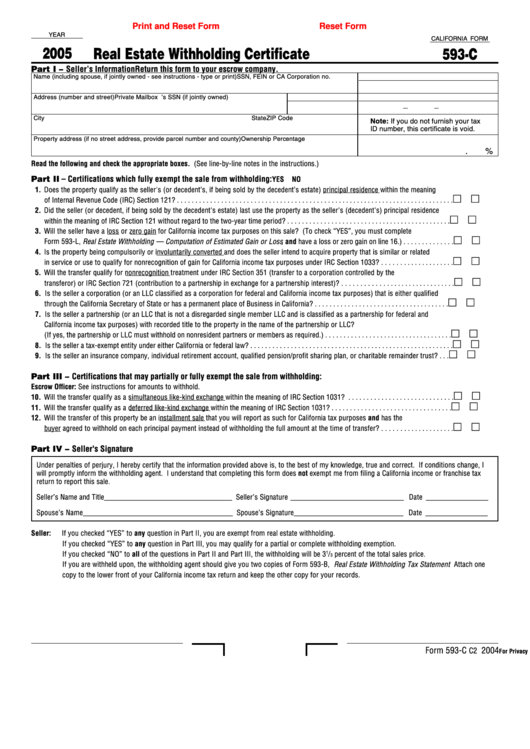

Print and Reset Form

Reset Form

YEAR

CALIFORNIA FORM

2005

Real Estate Withholding Certificate

593-C

Part I – Seller’s Information

Return this form to your escrow company.

Name (including spouse, if jointly owned - see instructions - type or print)

SSN, FEIN or CA Corporation no.

Address (number and street)

Private Mailbox no.

Spouse’s SSN (if jointly owned)

City

State

ZIP Code

Note: If you do not furnish your tax

ID number, this certificate is void.

Property address (if no street address, provide parcel number and county)

Ownership Percentage

.

%

Read the following and check the appropriate boxes. (See line-by-line notes in the instructions.)

Part II – Certifications which fully exempt the sale from withholding:

YES

NO

1. Does the property qualify as the seller's (or decedent’s, if being sold by the decedent’s estate) principal residence within the meaning

of Internal Revenue Code (IRC) Section 121? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Did the seller (or decedent, if being sold by the decedent's estate) last use the property as the seller's (decedent's) principal residence

within the meaning of IRC Section 121 without regard to the two-year time period? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Will the seller have a loss or zero gain for California income tax purposes on this sale? (To check “YES”, you must complete

Form 593-L, Real Estate Withholding — Computation of Estimated Gain or Loss , and have a loss or zero gain on line 16.) . . . . . . . . . . . . . .

4. Is the property being compulsorily or involuntarily converted and does the seller intend to acquire property that is similar or related

in service or use to qualify for nonrecognition of gain for California income tax purposes under IRC Section 1033? . . . . . . . . . . . . . . . . . . . .

5. Will the transfer qualify for nonrecognition treatment under IRC Section 351 (transfer to a corporation controlled by the

transferor) or IRC Section 721 (contribution to a partnership in exchange for a partnership interest)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Is the seller a corporation (or an LLC classified as a corporation for federal and California income tax purposes) that is either qualified

through the California Secretary of State or has a permanent place of Business in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Is the seller a partnership (or an LLC that is not a disregarded single member LLC and is classified as a partnership for federal and

California income tax purposes) with recorded title to the property in the name of the partnership or LLC?

(If yes, the partnership or LLC must withhold on nonresident partners or members as required.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Is the seller a tax-exempt entity under either California or federal law? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Is the seller an insurance company, individual retirement account, qualified pension/profit sharing plan, or charitable remainder trust? . . .

Part III – Certifications that may partially or fully exempt the sale from withholding:

Escrow Officer: See instructions for amounts to withhold.

10. Will the transfer qualify as a simultaneous like-kind exchange within the meaning of IRC Section 1031? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Will the transfer qualify as a deferred like-kind exchange within the meaning of IRC Section 1031? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Will the transfer of this property be an installment sale that you will report as such for California tax purposes and has the

buyer agreed to withhold on each principal payment instead of withholding the full amount at the time of transfer? . . . . . . . . . . . . . . . . . . . .

Part IV – Seller's Signature

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. If conditions change, I

will promptly inform the withholding agent. I understand that completing this form does not exempt me from filing a California income or franchise tax

return to report this sale.

Seller’s Name and Title ___________________________________ Seller’s Signature _______________________________ Date _________________

Spouse’s Name _________________________________________ Spouse’s Signature ______________________________ Date _________________

Seller:

If you checked “YES” to any question in Part II, you are exempt from real estate withholding.

If you checked “YES” to any question in Part III, you may qualify for a partial or complete withholding exemption.

If you checked “NO” to all of the questions in Part II and Part III, the withholding will be 3

1

/

percent of the total sales price.

3

If you are withheld upon, the withholding agent should give you two copies of Form 593-B, Real Estate Withholding Tax Statement . Attach one

copy to the lower front of your California income tax return and keep the other copy for your records.

593C04103

Form 593-C

2004

C2

For Privacy Act Notice, get form FTB 1131 (Individuals only).

1

1