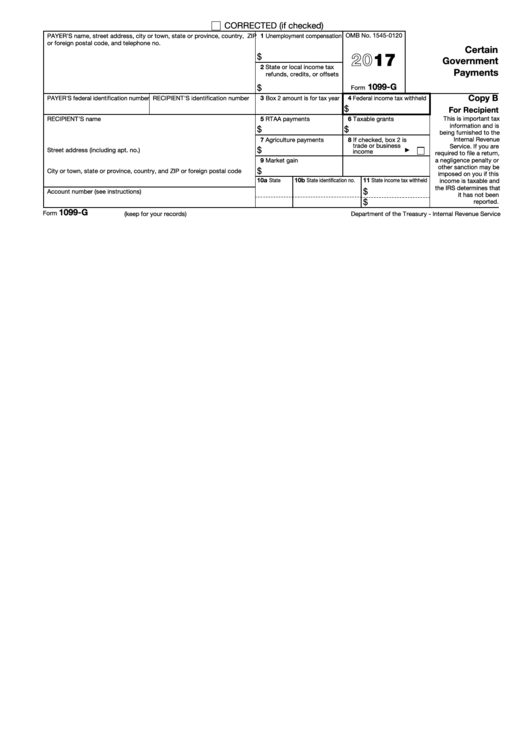

Form 1099-G - Certain Government Payments - 2017

ADVERTISEMENT

CORRECTED (if checked)

PAYER'S name, street address, city or town, state or province, country, ZIP

1 Unemployment compensation

OMB No. 1545-0120

or foreign postal code, and telephone no.

Certain

2017

$

Government

2 State or local income tax

Payments

refunds, credits, or offsets

1099-G

$

Form

Copy B

PAYER'S federal identification number RECIPIENT'S identification number

3 Box 2 amount is for tax year

4 Federal income tax withheld

$

For Recipient

RECIPIENT'S name

5 RTAA payments

6 Taxable grants

This is important tax

information and is

$

$

being furnished to the

Internal Revenue

7 Agriculture payments

8 If checked, box 2 is

trade or business

Service. If you are

$

Street address (including apt. no.)

income

required to file a return,

9 Market gain

a negligence penalty or

other sanction may be

$

City or town, state or province, country, and ZIP or foreign postal code

imposed on you if this

10a

10b

11

State

State identification no.

State income tax withheld

income is taxable and

the IRS determines that

$

Account number (see instructions)

it has not been

$

reported.

1099-G

Form

(keep for your records)

Department of the Treasury - Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1