Form Uct-5334 - Agricultural Employer'S Report - 2013 Page 2

ADVERTISEMENT

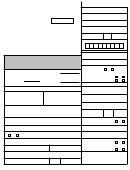

17. If you have any employees in any of the Excluded Categories below, check all that apply:

A sole proprietor's father, mother, spouse, or any of his/her children under the age of 18. Identify those claimed:

Father

Mother

Spouse

Child under 18 - Give Birthdate ____________

Child under 18 - Give Birthdate ____________

Child under 18 - Give Birthdate ____________

Unpaid corporate officers

Show gross cash wages

Complete the following record of your quarterly agricultural payroll in Wisconsin.

paid in each

18.

Do not

calendar quarter.

include wages for employees shown as excluded in question 17.

YEAR

1st QTR. JAN-MAR

2nd QTR. APR-JUNE

3rd QTR. JULY-SEPT

4th QTR. OCT-DEC

2011

2012

2013

Do you have employment outside of Wisconsin?

No

If yes, give number of those employees: ____

Yes

19.

20.

Are you liable for Federal Unemployment Tax on your agricultural payroll for the calendar years:

Yes

No

2011

Yes

No

2012

Yes

No

2013

Indicate whether you had 20 weeks in which at least 10 employees worked full or part-time on one or more days in

21.

agricultural labor (not counting employees working in excluded employment). If you answer yes, give the date the 20th

week ended.

Yes

No

2011

If yes, date: _____________

2012

Yes

No

If yes, date: _____________

2013

Yes

No

If yes, date: _____________

Section 108.24(2) provides for fines and/or imprisonment for making known false statements on this report or for

refusing to submit the completed report to this office.

Your signature below indicates the report is true and

complete to the best of your knowledge and belief.

Date Signed

Signature

(U00604) (R. 11/19/2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2