Form Ftb 1077 - Guidelines For Social And Recreational Organizations

ADVERTISEMENT

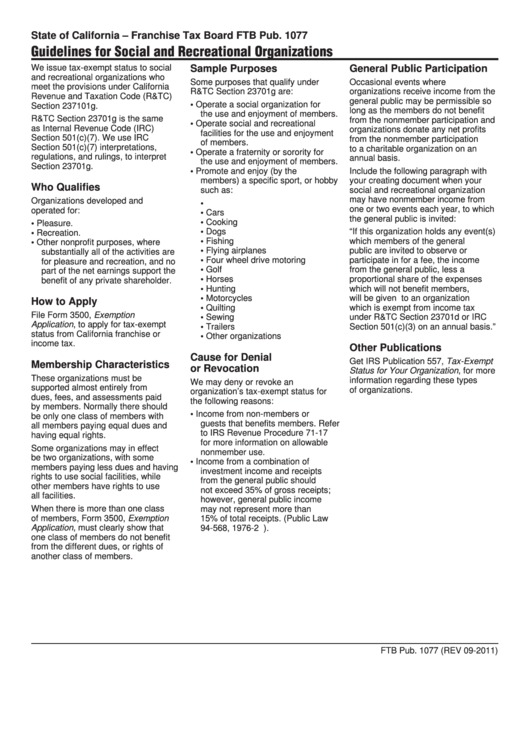

State of California – Franchise Tax Board

FTB Pub. 1077

Guidelines for Social and Recreational Organizations

We issue tax-exempt status to social

Sample Purposes

General Public Participation

and recreational organizations who

Some purposes that qualify under

Occasional events where

meet the provisions under California

R&TC Section 23701g are:

organizations receive income from the

Revenue and Taxation Code (R&TC)

general public may be permissible so

• Operate a social organization for

Section 237101g.

long as the members do not benefit

the use and enjoyment of members.

R&TC Section 23701g is the same

from the nonmember participation and

• Operate social and recreational

as Internal Revenue Code (IRC)

organizations donate any net profits

facilities for the use and enjoyment

Section 501(c)(7). We use IRC

from the nonmember participation

of members.

Section 501(c)(7) interpretations,

to a charitable organization on an

• Operate a fraternity or sorority for

regulations, and rulings, to interpret

annual basis.

the use and enjoyment of members.

Section 23701g.

• Promote and enjoy (by the

Include the following paragraph with

members) a specific sport, or hobby

your creating document when your

Who Qualifies

such as:

social and recreational organization

may have nonmember income from

Organizations developed and

• C.B. radios

one or two events each year, to which

operated for:

• Cars

the general public is invited:

• Cooking

• Pleasure.

• Dogs

“If this organization holds any event(s)

• Recreation.

• Fishing

which members of the general

• Other nonprofit purposes, where

• Flying airplanes

public are invited to observe or

substantially all of the activities are

• Four wheel drive motoring

participate in for a fee, the income

for pleasure and recreation, and no

• Golf

from the general public, less a

part of the net earnings support the

• Horses

proportional share of the expenses

benefit of any private shareholder.

• Hunting

which will not benefit members,

• Motorcycles

will be given to an organization

How to Apply

• Quilting

which is exempt from income tax

File Form 3500, Exemption

• Sewing

under R&TC Section 23701d or IRC

Application, to apply for tax-exempt

• Trailers

Section 501(c)(3) on an annual basis.”

status from California franchise or

• Other organizations

income tax.

Other Publications

Cause for Denial

Get IRS Publication 557, Tax-Exempt

Membership Characteristics

or Revocation

Status for Your Organization, for more

These organizations must be

information regarding these types

We may deny or revoke an

supported almost entirely from

of organizations.

organization’s tax-exempt status for

dues, fees, and assessments paid

the following reasons:

by members. Normally there should

• Income from non-members or

be only one class of members with

guests that benefits members. Refer

all members paying equal dues and

to IRS Revenue Procedure 71-17

having equal rights.

for more information on allowable

Some organizations may in effect

nonmember use.

be two organizations, with some

• Income from a combination of

members paying less dues and having

investment income and receipts

rights to use social facilities, while

from the general public should

other members have rights to use

not exceed 35% of gross receipts;

all facilities.

however, general public income

When there is more than one class

may not represent more than

of members, Form 3500, Exemption

15% of total receipts. (Public Law

Application, must clearly show that

94-568, 1976-2 C.B. 596).

one class of members do not benefit

from the different dues, or rights of

another class of members.

FTB Pub. 1077 (REV 09-2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1