Reset Form

Print & Sign to Submit

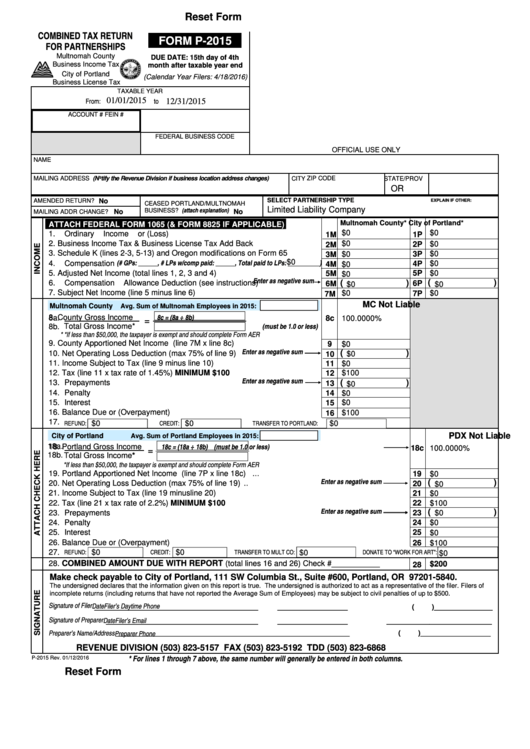

COMBINED TAX RETURN

FORM P-2015

FOR PARTNERSHIPS

Multnomah County

DUE DATE: 15th day of 4th

Business Income Tax

month after taxable year end

City of Portland

(Calendar Year Filers: 4/18/2016)

Business License Tax

TAXABLE YEAR

From:

to

01/01/2015

12/31/2015

ACCOUNT #

FEIN #

FEDERAL BUSINESS CODE

OFFICIAL USE ONLY

NAME

MAILING ADDRESS (Notify the Revenue Division if business location address changes)

CITY

STATE/PROV

ZIP CODE

OR

SELECT PARTNERSHIP TYPE

AMENDED RETURN?

No

EXPLAIN IF OTHER:

CEASED PORTLAND/MULTNOMAH

BUSINESS? (attach explanation)

Limited Liability Company

No

No

MAILING ADDR CHANGE?

Multnomah County*

City of Portland*

ATTACH FEDERAL FORM 1065 (& FORM 8825 IF APPLICABLE)

$0

$0

1.

Ordinary Income or (Loss) ........................................................................

1P

1M

2.

Business Income Tax & Business License Tax Add Back .........................

$0

$0

2M

2P

3.

Schedule K (lines 2-3, 5-13) and Oregon modifications on Form 65 ........

$0

$0

3M

3P

$0

(# GPs: ______, # LPs w/comp paid: ______, Total paid to LPs: __________)

4.

Compensation

$0

4P

4M

$0

5.

Adjusted Net Income (total lines 1, 2, 3 and 4) ..........................................

5M

5P

$0

$0

Enter as negative sum

(

)

6.

Compensation Allowance Deduction (see instructions) .............................

(

)

6P

6M

$0

$0

7.

Subject Net Income (line 5 minus line 6) ..................................................

$0

$0

7M

7P

MC Not Liable

Multnomah County

Avg. Sum of Multnomah Employees in 2015:

8c = (8a ÷ 8b)

8a.

8.

County Gross Income

..........

8c

100.0000%

=

(must be 1.0 or less)

Total Gross Income*

8b.

* *If less than $50,000, the taxpayer is exempt and should complete Form AER

9.

County Apportioned Net Income (line 7M x line 8c) .................................

9

$0

Enter as negative sum

10. Net Operating Loss Deduction (max 75% of line 9) ...................................

(

)

$0

10

11. Income Subject to Tax (line 9 minus line 10) ............................................

11

$0

12. Tax (line 11 x tax rate of 1.45%) MINIMUM $100 .....................................

$100

12

Enter as negative sum

13. Prepayments .............................................................................................

(

)

13

$0

14. Penalty ......................................................................................................

14

$0

15. Interest ......................................................................................................

$0

15

16. Balance Due or (Overpayment) .................................................................

$100

16

17.

REFUND:

CREDIT:

TRANSFER TO PORTLAND:

$0

$0

$0

PDX Not Liable

City of Portland

Avg. Sum of Portland Employees in 2015:

18a.

18c = (18a ÷ 18b) (must be 1.0 or less)

18. Portland Gross Income

.........

18c

100.0000%

=

18b.

Total Gross Income*

*If less than $50,000, the taxpayer is exempt and should complete Form AER

19. Portland Apportioned Net Income (line 7P x line 18c) .......................................................................

19

$0

Enter as negative sum

(

)

20. Net Operating Loss Deduction (max 75% of line 19) ...........................................................................

20

$0

21. Income Subject to Tax (line 19 minus line 20) ....................................................................................

21

$0

22

$100

22. Tax (line 21 x tax rate of 2.2%) MINIMUM $100 .................................................................................

Enter as negative sum

(

)

23. Prepayments .......................................................................................................................................

23

$0

24. Penalty ................................................................................................................................................

24

$0

25. Interest ................................................................................................................................................

25

$0

26. Balance Due or (Overpayment)

26

$100

REFUND:

CREDIT:

TRANSFER TO MULT CO:

DONATE TO “WORK FOR ART”:

27.

$0

$0

$0

$0

28.

COMBINED AMOUNT DUE WITH REPORT

(total lines 16 and 26) Check #___________ ..........

$200

28

Make check payable to City of Portland, 111 SW Columbia St., Suite #600, Portland, OR 97201-5840.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer. Filers of

incomplete returns (including returns that have not reported the Average Sum of Employees) may be subject to civil penalties of up to $500.

Signature of Filer

Date

Filer’s Daytime Phone

__________________________________________

__________________

(

)_______________

Signature of Preparer

Date

Filer’s Email

_______________________________________

__________________

___________________________

Preparer’s Name/Address

Preparer Phone

____________________________________________________________

(

)__________________

REVENUE DIVISION (503) 823-5157

FAX (503) 823-5192

TDD (503) 823-6868

* For lines 1 through 7 above, the same number will generally be entered in both columns.

P-2015 Rev. 01/12/2016

Print & Sign to Submit

Reset Form

1

1