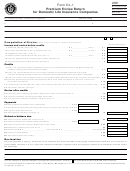

Part I. Premium Excise

Activity for the Year Ending December 31, 2000

Life insurance

Accident and health insurance

a.

b.

c.

d.

Jurisdictions

Jurisdictions

where no insurance

where no insurance

Massachusetts

excise paid

Massachusetts

excise paid

11 All new and renewal (direct) premiums

❿

❿

❿

❿

for Massachusetts residents . . . . . . . . . . . . . . 11

12 Dividends applied to:

❿

❿

❿

❿

a Purchase paid-up additions . . . . . . . . . . . 12a

❿

❿

❿

❿

b Shorten premium paying period. . . . . . . . 12b

13 Total. Add line 1 through line 2b . . . . . . . . . . . 13

Deductions.

Include only what has been returned as receipts on this return or on a previous return.

14 Returned premiums but not including cash

❿

❿

❿

❿

surrender values (attach schedule). . . . . . . . . 14

15 Premiums for company employees’ group

life and accident and health plans

❿

❿

❿

❿

if included in line 1*. . . . . . . . . . . . . . . . . . . . . 15

16 Gross premiums for authorized

❿

❿

❿

❿

preferred provider arrangements . . . . . . . . . . 16

17 Dividends:

❿

❿

❿

❿

a Paid in cash . . . . . . . . . . . . . . . . . . . . . . . 17a

b Applied in reduction of renewal

❿

❿

❿

❿

premiums. . . . . . . . . . . . . . . . . . . . . . . . . 17b

❿

❿

❿

❿

c Left to accumulate at interest. . . . . . . . . . 17c

❿

❿

❿

❿

d Applied to purchase paid-up additions . . . 17d

e Applied to shorten premium paying

❿

❿

❿

❿

period. . . . . . . . . . . . . . . . . . . . . . . . . . . . 17e

18 Total deductions.

Add lines 4 through 7e . . . . . . . . . . . . . . . . . . 18

19 Amount taxable.

Subtract line 8 from line 3 . . . . . . . . . . . . . . . . 19

10 Total life amount taxable. Add line 9, column A and column B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

$

11 Total accident and health amount taxable. Add line 9, column C and column D. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

$

*Premiums under the company employees’ group plans for annuity consideration and retirement benefits shall not be deducted.

Form DL-1

1

1 2

2