Privilege (Sales) And Use Tax - Return Instructions - City Of Glendale

ADVERTISEMENT

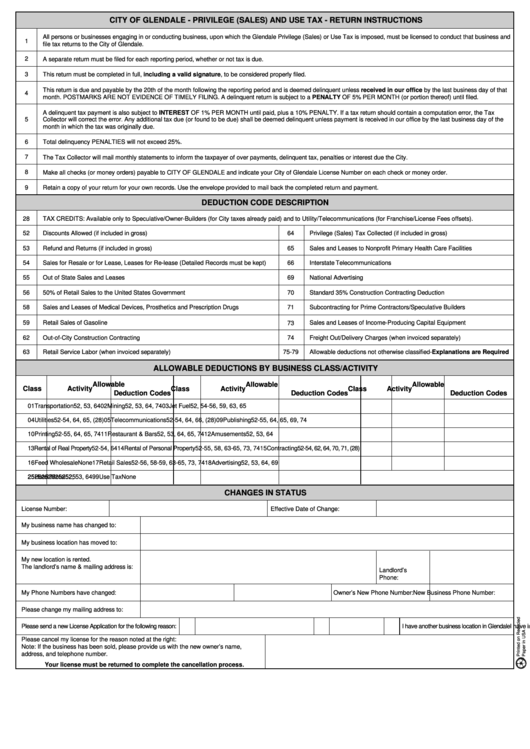

CITY OF GLENDALE - PRIVILEGE (SALES) AND USE TAX - RETURN INSTRUCTIONS

All persons or businesses engaging in or conducting business, upon which the Glendale Privilege (Sales) or Use Tax is imposed, must be licensed to conduct that business and

1

file tax returns to the City of Glendale.

2

A separate return must be filed for each reporting period, whether or not tax is due.

3

This return must be completed in full, including a valid signature, to be considered properly filed.

This return is due and payable by the 20th of the month following the reporting period and is deemed delinquent unless received in our office by the last business day of that

4

month. POSTMARKS ARE NOT EVIDENCE OF TIMELY FILING. A delinquent return is subject to a PENALTY OF 5% PER MONTH (or portion thereof) until filed.

A delinquent tax payment is also subject to INTEREST OF 1% PER MONTH until paid, plus a 10% PENALTY. If a tax return should contain a computation error, the Tax

5

Collector will correct the error. Any additional tax due (or found to be due) shall be deemed delinquent unless payment is received in our office by the last business day of the

month in which the tax was originally due.

6

Total delinquency PENALTIES will not exceed 25%.

7

The Tax Collector will mail monthly statements to inform the taxpayer of over payments, delinquent tax, penalties or interest due the City.

8

Make all checks (or money orders) payable to CITY OF GLENDALE and indicate your City of Glendale License Number on each check or money order.

9

Retain a copy of your return for your own records. Use the envelope provided to mail back the completed return and payment.

DEDUCTION CODE DESCRIPTION

28

TAX CREDITS: Available only to Speculative/Owner-Builders (for City taxes already paid) and to Utility/Telecommunications (for Franchise/License Fees offsets).

52

Discounts Allowed (if included in gross)

64

Privilege (Sales) Tax Collected (if included in gross)

53

Refund and Returns (if included in gross)

65

Sales and Leases to Nonprofit Primary Health Care Facilities

54

Sales for Resale or for Lease, Leases for Re-lease (Detailed Records must be kept)

66

Interstate Telecommunications

55

Out of State Sales and Leases

69

National Advertising

56

50% of Retail Sales to the United States Government

70

Standard 35% Construction Contracting Deduction

58

Sales and Leases of Medical Devices, Prosthetics and Prescription Drugs

71

Subcontracting for Prime Contractors/Speculative Builders

59

Retail Sales of Gasoline

73

Sales and Leases of Income-Producing Capital Equipment

62

Out-of-City Construction Contracting

74

Freight Out/Delivery Charges (when invoiced separately)

63

Retail Service Labor (when invoiced separately)

75-79

Allowable deductions not otherwise classified-Explanations are Required

ALLOWABLE DEDUCTIONS BY BUSINESS CLASS/ACTIVITY

Allowable

Allowable

Allowable

Class

Activity

Class

Activity

Class

Activity

Deduction Codes

Deduction Codes

Deduction Codes

01

Transportation

52, 53, 64

02

Mining

52, 53, 64, 74

03

Jet Fuel

52, 54-56, 59, 63, 65

04

Utilities

52-54, 64, 65, (28)

05

Telecommunications

52-54, 64, 66, (28)

09

Publishing

52-55, 64, 65, 69, 74

10

Printing

52-55, 64, 65, 74

11

Restaurant & Bars

52, 53, 64, 65, 74

12

Amusements

52, 53, 64

13

Rental of Real Property 52-54, 64

14

Rental of Personal Property 52-55, 58, 63-65, 73, 74

15

Contracting

52-54, 62, 64, 70, 71, (28)

16

Feed Wholesale

None

17

Retail Sales

52-56, 58-59, 63-65, 73, 74

18

Advertising

52, 53, 64, 69

25

25

25

25

25

25

25

25

Hotel/Motel

52, 53, 64

99

Use Tax

None

CHANGES IN STATUS

License Number:

Effective Date of Change:

My business name has changed to:

My business location has moved to:

My new location is rented.

The landlord’s name & mailing address is:

Landlord’s

Phone:

My Phone Numbers have changed:

New Business Phone Number:

Owner’s New Phone Number:

Please change my mailing address to:

Please send a new License Application for the following reason:

The ownership of my business has changed

I have incorporated

I have another business location in Glendale

Please cancel my license for the reason noted at the right:

Note: If the business has been sold, please provide us with the new owner’s name,

address, and telephone number.

Your license must be returned to complete the cancellation process.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1