ABC

Over 6

Lag Date

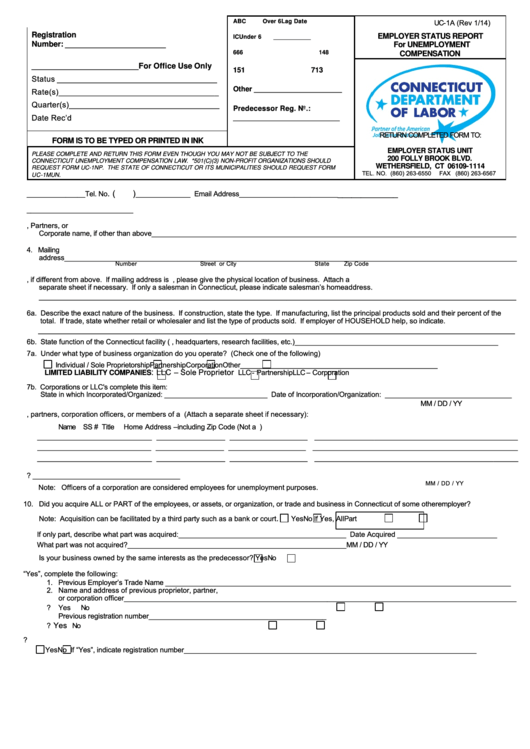

UC-1A (Rev 1/14)

Registration

EMPLOYER STATUS REPORT

IC

Under 6

___________

Number: ______________________

For UNEMPLOYMENT

666

148

COMPENSATION

________________________For Office Use Only

151

713

Status ___________________________________

Other ______________________

Rate(s)___________________________________

Quarter(s)_________________________________

Predecessor Reg. No.:

Date Rec’d

___________________________

RETURN COMPLETED FORM TO:

FORM IS TO BE TYPED OR PRINTED IN INK

EMPLOYER STATUS UNIT

PLEASE COMPLETE AND RETURN THIS FORM EVEN THOUGH YOU MAY NOT BE SUBJECT TO THE

200 FOLLY BROOK BLVD.

CONNECTICUT UNEMPLOYMENT COMPENSATION LAW. *501(C)(3) NON-PROFIT ORGANIZATIONS SHOULD

WETHERSFIELD, CT 06109-1114

REQUEST FORM UC-1NP. THE STATE OF CONNECTICUT OR ITS MUNICIPALITIES SHOULD REQUEST FORM

TEL. NO. (860) 263-6550

FAX (860) 263-6567

UC-1MUN.

. (

)

_____________

1. Federal Identification Number _______________ Tel. No

______________ Email Address _________________________

2. Business or Trade Name_____________________________________________________________________________________________________

3. Name of Owner, Partners, or

Corporate name, if other than above_____________________________________________________________________________________________

4. Mailing

address___________________________________________________________________________________________________________________

Street or P.O. Box

City

Number

State

Zip Code

5. List all Connecticut business locations, if different from above. If mailing address is P.O. Box, please give the physical location of business. Attach a

separate sheet if necessary. If only a salesman in Connecticut, please indicate salesman’s home address.

___________________________________________________________________________________________________________

6a. Describe the exact nature of the business. If construction, state the type. If manufacturing, list the principal products sold and their percent of the

total. If trade, state whether retail or wholesaler and list the type of products sold. If employer of HOUSEHOLD help, so indicate.

_________________________________________________________________________________________________________

6b. State function of the Connecticut facility (i.e., headquarters, research facilities, etc.)___________________________________________________

7a. Under what type of business organization do you operate? (Check one of the following)

Individual / Sole Proprietorship

Partnership

Corporation

Other__________________________________________________

:

LLC – Sole Proprietor

LLC - Partnership

LLC – Corporation

LIMITED LIABILITY COMPANIES

7b. Corporations or LLC's complete this item:

State in which Incorporated/Organized: __________________________ Date of Incorporation/Organization: ________________________________

MM / DD / YY

8.

List proprietor, partners, corporation officers, or members of a L.L.C. (Attach a separate sheet if necessary):

Name

SS #

Title

Home Address – including Zip Code (Not a P.O. Box)

_________________________ _______________ _________________ _____________________________________________

_________________________ _______________ _________________ _____________________________________________

_________________________ _______________ _________________ _____________________________________________

9. When did you first engage employees working in Connecticut under your present type of organization? _____________________________________

MM / DD / YY

Note: Officers of a corporation are considered employees for unemployment purposes.

10. Did you acquire ALL or PART of the employees, or assets, or organization, or trade and business in Connecticut of some other employer?

.

Note: Acquisition can be facilitated by a third party such as a bank or court

Yes

No

If Yes, All

Part

If only part, describe what part was acquired:__________________________________________ Date Acquired _________________________

What part was not acquired?_______________________________________________________

MM / DD / YY

Is your business owned by the same interests as the predecessor?

Yes

No

11. If the answer to Item 10 is “Yes”, complete the following:

1. Previous Employer’s Trade Name ________________________________________________________________________________________

2. Name and address of previous proprietor, partner,

or corporation officer___________________________________________________________________________________________________

3. Was the previous employer subject to Connecticut Unemployment Compensation Law?

Yes

No

Previous registration number_____________________________________________

Yes

4. Will the previous employer remain in business in Connecticut?

No

12. Were you previously or are you now registered as an employer with the Connecticut Labor Department?

Yes

No If “Yes”, indicate registration number__________________________________________________________________________

1

1 2

2